In the lastest in a recent trend, a major UK high street retailer (Debenhams) has failed, and the name was bought for £55 million. All 118 shops and most of the jobs are going. I am mostly amazed the name is worth so much.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Economic & Business News

- Thread starter Birdjaguar

- Start date

Public recognition can go a long way. Building a brand can take years and years. Building on an existing one can be much easier.In the lastest in a recent trend, a major UK high street retailer (Debenhams) has failed, and the name was bought for £55 million. All 118 shops and most of the jobs are going. I am mostly amazed the name is worth so much.

Public recognition can go a long way. Building a brand can take years and years. Building on an existing one can be much easier.

The company srtarted in 1778 en from 1813 onward Debenham was in the name, from 1905 Debenham was the only name and in 1928 it was listed on the London Stock Exchange.

Around 55 million for approx 200 years is roughly 250,000 per year for the brand building.

I am not familiar with the name, but I hope they don't destroy the brand in the next 12 months.

I miss some old brands. The Great Atlantic and Pacific Tea Company became A&P Grocery stores which became extinct.

Brand names can also be vulnerable to unfortunate events.

When Heineken, the big Dutch beer brewer launched its first alcohol free beer with the name Buckler... one New Years Eve cabaret show destroyed that name because of a joke and almost all Dutch people watching that traditional show. As a consequence it was withdrawn from the Dutch market by Heineken, but it still sells in some other countries.

I was involved in naming some new metallurgical processes, and it is amazing what you need to take into account. Things like that your super name in your own market languages means someting controversial in another language. And you do want your brand name for a needed process on the technical drawings of customers.

And on old brand names: you have that big retail chain in clothing C&A, originally from a Clement and August (Brenninkmeijer), founded in the 19th century in NL. They grew very fast very big in early 20th century by introducing contribution margin-based pricing. Not the profit percentages as objective, but the total added profit contribution from volume multiplied with the absolute margin, the mass retail principle pushing out traditional retail by lower pricing to customers.

And then when expanding the business to English speaking countries the C&A became Cheap & Awfull...

But they survived that just as Corona beer survived the Corona pandemy.

When Heineken, the big Dutch beer brewer launched its first alcohol free beer with the name Buckler... one New Years Eve cabaret show destroyed that name because of a joke and almost all Dutch people watching that traditional show. As a consequence it was withdrawn from the Dutch market by Heineken, but it still sells in some other countries.

I was involved in naming some new metallurgical processes, and it is amazing what you need to take into account. Things like that your super name in your own market languages means someting controversial in another language. And you do want your brand name for a needed process on the technical drawings of customers.

And on old brand names: you have that big retail chain in clothing C&A, originally from a Clement and August (Brenninkmeijer), founded in the 19th century in NL. They grew very fast very big in early 20th century by introducing contribution margin-based pricing. Not the profit percentages as objective, but the total added profit contribution from volume multiplied with the absolute margin, the mass retail principle pushing out traditional retail by lower pricing to customers.

And then when expanding the business to English speaking countries the C&A became Cheap & Awfull...

But they survived that just as Corona beer survived the Corona pandemy.

And the Trump brand is currently under going a change in the public's mind too.

And the Trump brand is currently under going a change in the public's mind too.

The nice thing as well is that a lot of rats came out of their holes and walked and walk in the open field with words and deeds

China’s Big Tech clampdown

In China, Alibaba commands 62 percent of the country’s online retail market, according to investment firm Daiwa Capital Markets. Its closest competitor, JD.com, controls about 20 percent. Alibaba’s estimated 750 million active users are more than double the number for United States-based e-commerce giant Amazon, which claims to have more than 300 million active users.

Alibaba’s growth has been meteoric. For instance, Taobao Live’s gross merchandise value, a measure of sales, has expanded by about 150 percent a year for three years, Alibaba said in a report last March.

The first sign of Beijing’s wariness of the rise of e-commerce and financial technology giants came shortly after Alibaba’s flamboyant billionaire founder, Jack Ma, made a speech in Shanghai on October 24 in which he criticised China’s financial regulators for not being innovative enough.

As he was speaking, his financial technology firm, Ant Group, was preparing for what was slated to be an initial public offering (IPO) to raise about $37bn, the world’s largest ever.

On November 3, 10 days after his Shanghai speech, Chinese regulators blocked the IPO, shocking investors around the world and sending share prices falling.

The authorities have since called for an overhaul of Ant’s business and launched an antitrust investigation into Alibaba. They have also published a draft list of new antitrust rules aimed at curbing monopolistic behaviour by giant internet platforms, covering everything from e-commerce to food delivery and more.

Alibaba’s growth has been meteoric. For instance, Taobao Live’s gross merchandise value, a measure of sales, has expanded by about 150 percent a year for three years, Alibaba said in a report last March.

The first sign of Beijing’s wariness of the rise of e-commerce and financial technology giants came shortly after Alibaba’s flamboyant billionaire founder, Jack Ma, made a speech in Shanghai on October 24 in which he criticised China’s financial regulators for not being innovative enough.

As he was speaking, his financial technology firm, Ant Group, was preparing for what was slated to be an initial public offering (IPO) to raise about $37bn, the world’s largest ever.

On November 3, 10 days after his Shanghai speech, Chinese regulators blocked the IPO, shocking investors around the world and sending share prices falling.

The authorities have since called for an overhaul of Ant’s business and launched an antitrust investigation into Alibaba. They have also published a draft list of new antitrust rules aimed at curbing monopolistic behaviour by giant internet platforms, covering everything from e-commerce to food delivery and more.

And Jack Ma disappeared from public view for a couple of months, but did make a brief appearance last week.

Ferocitus

Deity

IMF Economic Horoscope, Jan. 2021.

From: https://www.imf.org/-/media/Files/Publications/WEO/2021/Update/January/English/text.ashx

From: https://www.imf.org/-/media/Files/Publications/WEO/2021/Update/January/English/text.ashx

2020 sucked. 2021 certainly looks to be better. If vaccines make good progress, travel will make a huge difference in the second half of the year and next year.

IMF Economic Horoscope, Jan. 2021.

View attachment 583070

From: https://www.imf.org/-/media/Files/Publications/WEO/2021/Update/January/English/text.ashx

yeah

most developed countries losing 2-3 years GDP growth, some a bit longer.

China only 1 year, India & US 1.5 year.

Lexicus

Deity

They're predicting 5.1% GDP growth for the US this year?

*Professor Farnsworth laugh*

*Professor Farnsworth laugh*

4.5 for the UK is even less likely, how we could do better than Germany (3.5) I do not know.They're predicting 5.1% GDP growth for the US this year?

*Professor Farnsworth laugh*

The company that is buying the Debenhams website is already well established selling to young people. It spends a lot advertising.

It will presumably use the brand to target new segments like older folk using its existing IT and warehouses etc.

It will presumably use the brand to target new segments like older folk using its existing IT and warehouses etc.

Ferocitus

Deity

I did label it as a horoscope!They're predicting 5.1% GDP growth for the US this year?

*Professor Farnsworth laugh*

2020 was a disaster so, depending on the effectiveness of the vaccination roll-out, it might be achievable.

Who knows, after they saw the Buffalo-Horned Leader in the Capitol, China might help you out in the Year of the Ox.

Zardnaar

Deity

Overlooks some negatives.

EnglishEdward

Deity

And then when expanding the business to English speaking countries the C&A became Cheap & Awfull.

There were other expansions of that acronym.

Question: How do I know which way round to wear these panties/underpants:

Answer: They are clearly labelled C and A.

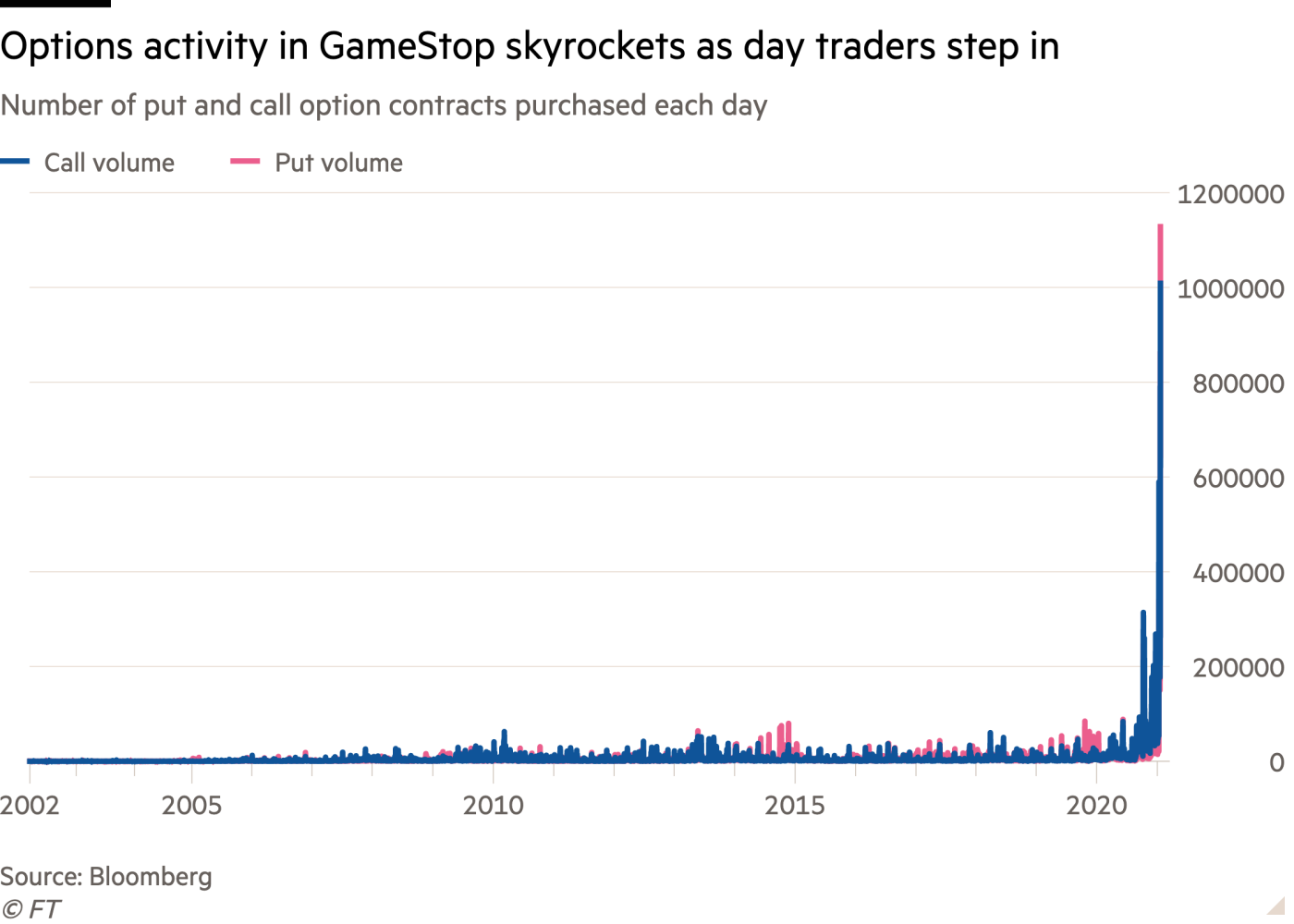

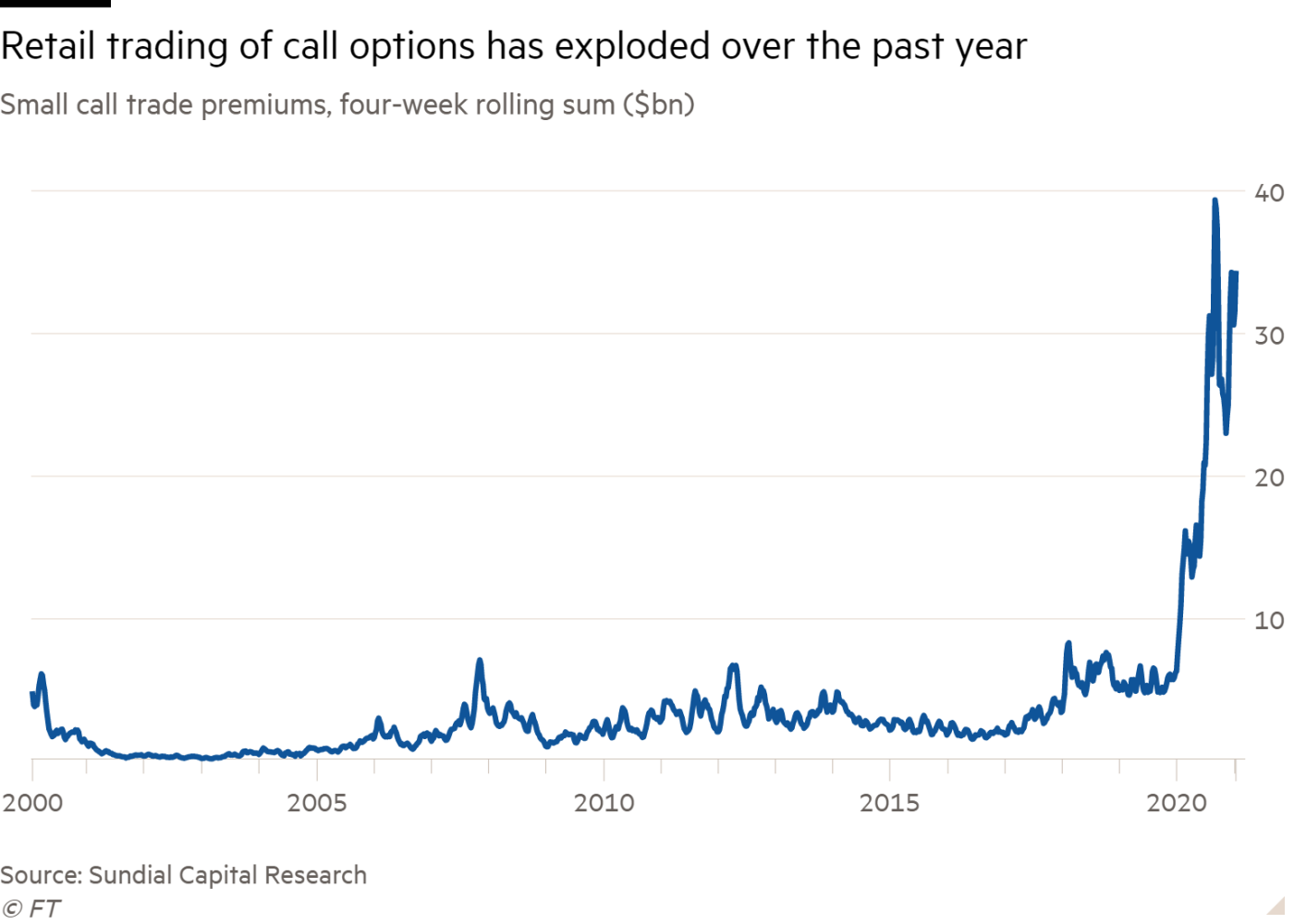

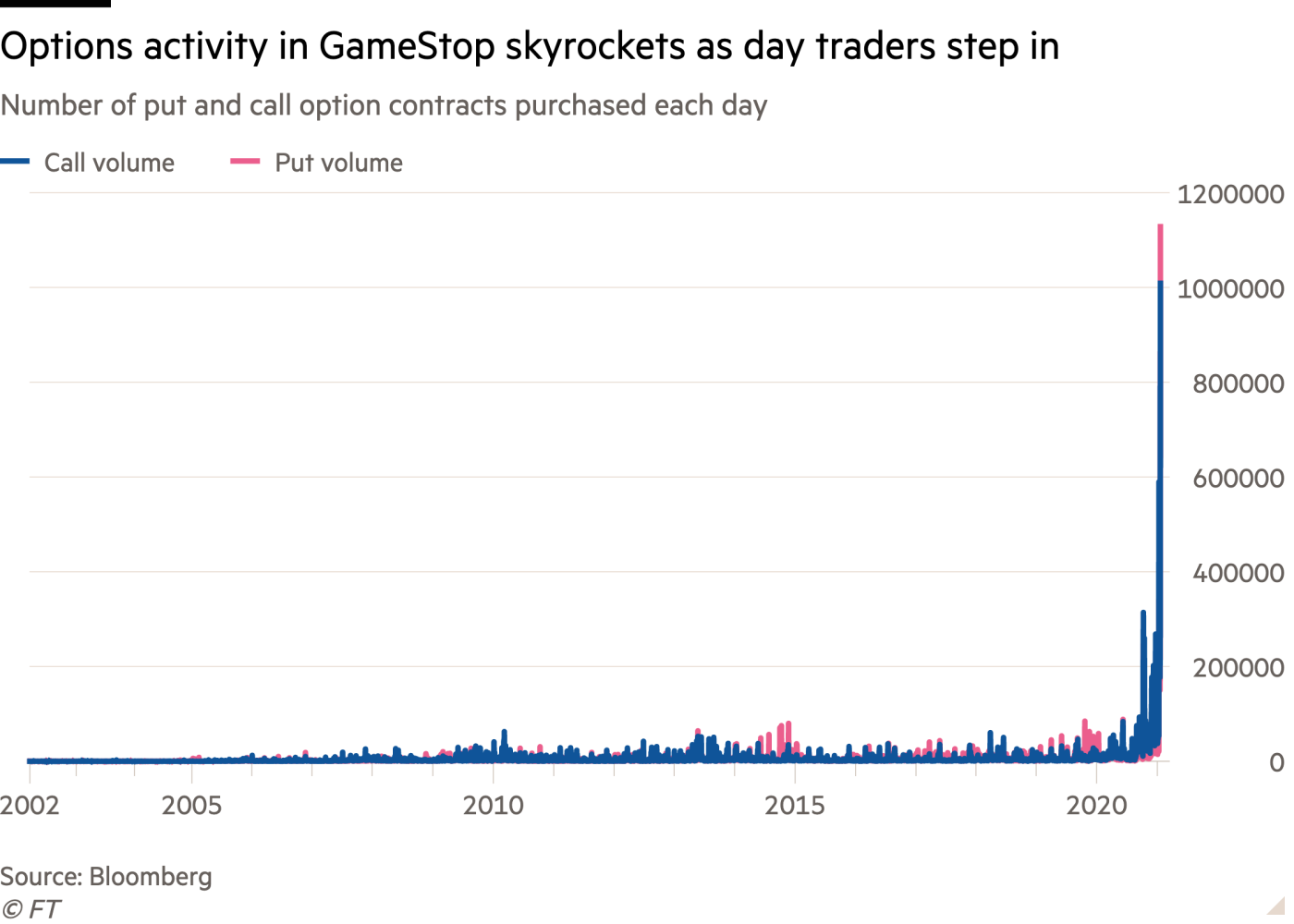

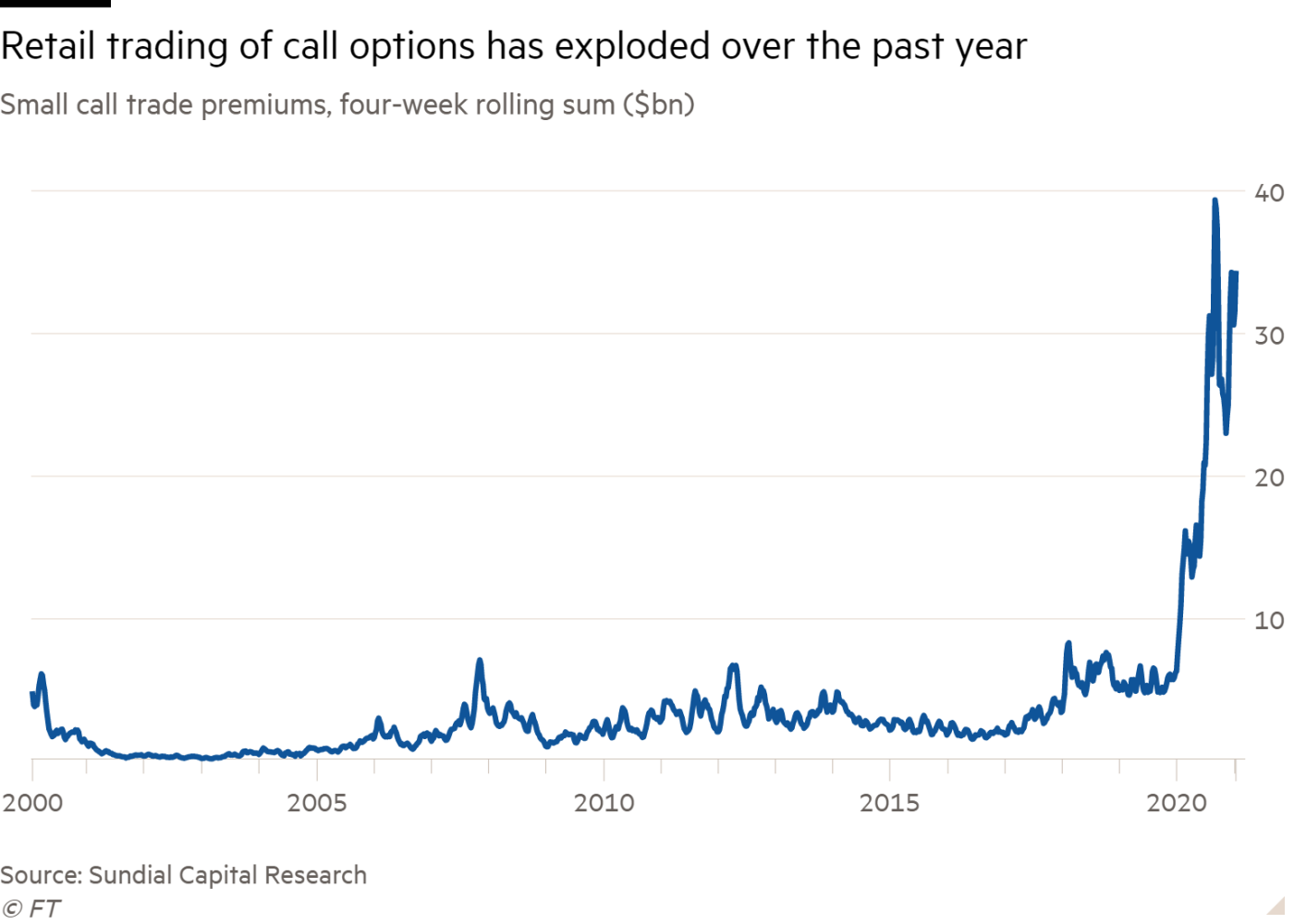

What on earth is going on with gamestop?

From my reading, it seems like there is a failing company, selling computer games in bricks and mortar stores. Retail investors are "taking on wall street" by betting it will go up in value, despite actually failing, and this is working?

Beeb FT Grundiad

From my reading, it seems like there is a failing company, selling computer games in bricks and mortar stores. Retail investors are "taking on wall street" by betting it will go up in value, despite actually failing, and this is working?

Spoiler More graphs :

Beeb FT Grundiad

Last edited:

Similar threads

- Replies

- 443

- Views

- 12K