Joij21

🔥Hail Satan!🔥

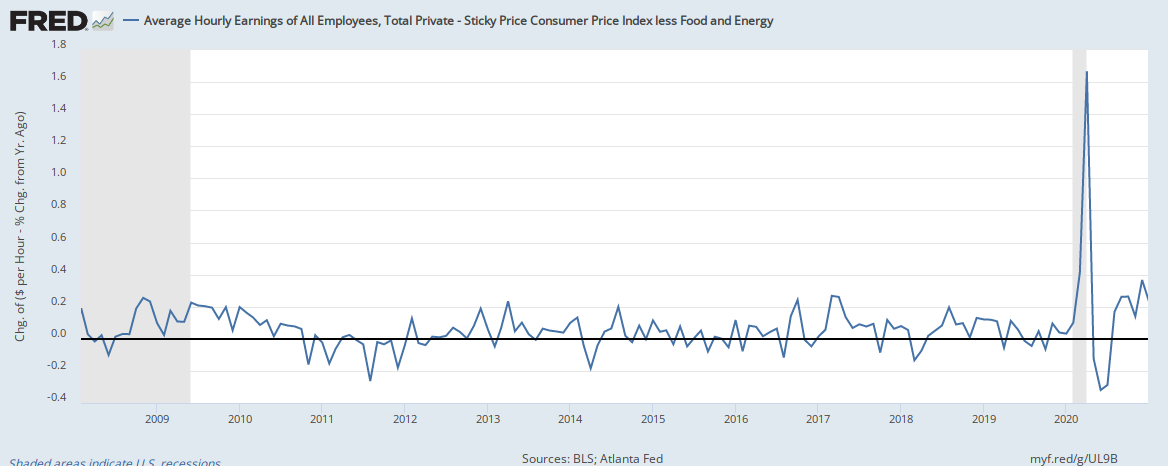

Well it looks like inflation is persistent now. So much for people's previous guestimates of it being transitory. Jerome Powell of the Fed is now raising interest rates, and other central banks are following suit in order to achieve currency parity with the dollar to offset economic woes via global trade inflated commodity prices.

Personally with inflation over 8% I believe he must raise the interest rate to 10%. Don't care if it causes a major recession, this will come back to bite us on the butt harder if the the whole system is not quashed now. Crushing the market is the only way to increase efficiency and get business to orient itself away from the irresponsible quick and easy money generating methods of the past ten years. It's time people feel the burn and get back to hard work, employment, and increased productivity. No more cutting corners, no more embezzlement, no more COVID handout scams, no more crypto, no more nepotism, no more insider ponzi schemes, no more work from home, no more nfts, no more free coffee and perks at the office, no more company payed vacations. Learn to make money the old fashioned way, strong work ethic, no debts.

Personally with inflation over 8% I believe he must raise the interest rate to 10%. Don't care if it causes a major recession, this will come back to bite us on the butt harder if the the whole system is not quashed now. Crushing the market is the only way to increase efficiency and get business to orient itself away from the irresponsible quick and easy money generating methods of the past ten years. It's time people feel the burn and get back to hard work, employment, and increased productivity. No more cutting corners, no more embezzlement, no more COVID handout scams, no more crypto, no more nepotism, no more insider ponzi schemes, no more work from home, no more nfts, no more free coffee and perks at the office, no more company payed vacations. Learn to make money the old fashioned way, strong work ethic, no debts.