JerichoHill

Bedrock of Knowledge

1. Click HERE

(http://crfb.org/stabilizethedebt/)

2. Play around and attempt to stabilize the debt

3. List your Solution and explain it.

(Note: CFRB is a non-partisan think-tank that's very concerned about our budget issues. They actually are non-partisan. Shocking)

JH's Solution:

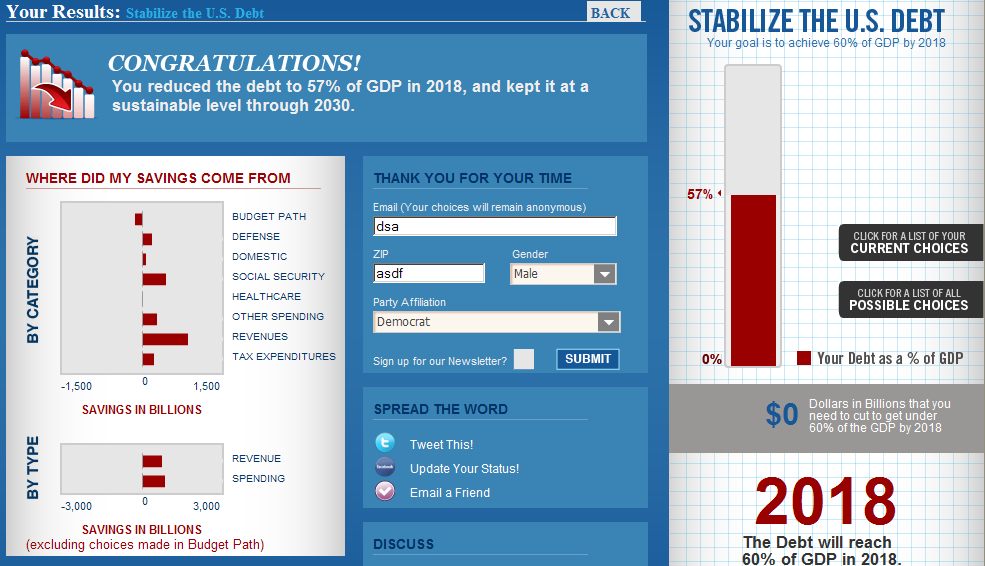

It is obvious that I'm an urban economist. We tend to look at transportation and housing tax issues as highly distortionary in their current set up, so we'd want to correct those. I may have been too harsh on the military and could be convinced (in a debate) to drop the dependent exemption increase and add back in all non-troop level military cuts (cut 190 there, get 170 back into the military). It also seems obvious that if we are measuring inflation in a biased fashion, correcting that should be a non-partisan easy fix.

Changes under the spoiler tag.

Spending

Reduce Troops to 60,000 by 2015 (Afghan + Iraq)

-$350B

Enact Administration's Proposed Weapon System Cuts

-$30B

Cancel Missile Defense System

-$50B

Reverse "Grow the Army" Initiative

-$90B

Cancel TARP and Rescind Unused ARRA Funds

-$350B

Enact New Jobs Bill

$210B

Grow Regular Discretionary Spending with Inflation

$0

Eliminate Certain Outdated Programs

-$40B

Reduce Farm Subsidies

-$80B

Cut Earmarks in Half

-$80B

Increase Mass Transit Funding

$60B

Revenue

Allow All the Tax Cuts, Except for AMT Patches, to Expire

$480

Gradually Reduce Food Stamps Benefits to 2008 Levels

-100B

Freeze Average Unemployment Benefits at 2009 Levels

-$50B

Progressively Reduce Benefits, Protecting Low and Medium Earners

-$60B

Use An Alternate Measure of Inflation for COLAs

-$100B

Increase Years Used to Calculate Benefits

-$40B

Include all New State and Local Workers into SS

-$80B

Enact Medical Malpractice Reform

-$50B

Increase User Fees Across the Board

-$40B

Increase Gas Tax by 10 Cents per Gallon

-$80B

Gradually Increase Dependent Exemption by $3,500

$190B

Index Tax Code to Alternate Measure of Inflation

-$80B

Improve Tax Collection (Reduce Tax Gap)

-$20B

Convert Mortgage Interest Deduction to a 20% Credit

-$190B

Eliminate Subsidies for Biofuels

-$110B

Expand the EITC and Child Tax Credit

$90B

Extend "American Opportunity" College Tax Credit

$60B

Repeal Excise Tax on High-Cost Plans (Health Care)

$10B

(http://crfb.org/stabilizethedebt/)

2. Play around and attempt to stabilize the debt

3. List your Solution and explain it.

(Note: CFRB is a non-partisan think-tank that's very concerned about our budget issues. They actually are non-partisan. Shocking)

JH's Solution:

It is obvious that I'm an urban economist. We tend to look at transportation and housing tax issues as highly distortionary in their current set up, so we'd want to correct those. I may have been too harsh on the military and could be convinced (in a debate) to drop the dependent exemption increase and add back in all non-troop level military cuts (cut 190 there, get 170 back into the military). It also seems obvious that if we are measuring inflation in a biased fashion, correcting that should be a non-partisan easy fix.

Changes under the spoiler tag.

Spoiler :

Spending

Reduce Troops to 60,000 by 2015 (Afghan + Iraq)

-$350B

Enact Administration's Proposed Weapon System Cuts

-$30B

Cancel Missile Defense System

-$50B

Reverse "Grow the Army" Initiative

-$90B

Cancel TARP and Rescind Unused ARRA Funds

-$350B

Enact New Jobs Bill

$210B

Grow Regular Discretionary Spending with Inflation

$0

Eliminate Certain Outdated Programs

-$40B

Reduce Farm Subsidies

-$80B

Cut Earmarks in Half

-$80B

Increase Mass Transit Funding

$60B

Revenue

Allow All the Tax Cuts, Except for AMT Patches, to Expire

$480

Gradually Reduce Food Stamps Benefits to 2008 Levels

-100B

Freeze Average Unemployment Benefits at 2009 Levels

-$50B

Progressively Reduce Benefits, Protecting Low and Medium Earners

-$60B

Use An Alternate Measure of Inflation for COLAs

-$100B

Increase Years Used to Calculate Benefits

-$40B

Include all New State and Local Workers into SS

-$80B

Enact Medical Malpractice Reform

-$50B

Increase User Fees Across the Board

-$40B

Increase Gas Tax by 10 Cents per Gallon

-$80B

Gradually Increase Dependent Exemption by $3,500

$190B

Index Tax Code to Alternate Measure of Inflation

-$80B

Improve Tax Collection (Reduce Tax Gap)

-$20B

Convert Mortgage Interest Deduction to a 20% Credit

-$190B

Eliminate Subsidies for Biofuels

-$110B

Expand the EITC and Child Tax Credit

$90B

Extend "American Opportunity" College Tax Credit

$60B

Repeal Excise Tax on High-Cost Plans (Health Care)

$10B