Hygro

soundcloud.com/hygro/

This is a wall discussion that got too big.

How can you say if you don't know how to measure the economy that Obama's been bad? You know what's more fashionable than blaming Bush? That saying he's had four years and so the economy should be perfect so since it's not, he's failed.

There are two main kinds of recessions in the fiat-currency world (i.e. non-gold backed currency): there's the interest rate recession and there's the financial crisis recession/depression.

Most every recession since WW2 has been an interest rate recession: the economy ran too hot, and the federal reserve, foreseeing problems, would raise interest rates until things cooled back to a strong equilibrium. During this process, weaker businesses would get pruned from the economy. Raising interest rates raise the cost of borrowing which slows down capital (like machines, land, the cost of labor's + education value etc) and hiring (just labor) which reduces firm output as well as consumer demand to buy the stuff. So unemployment spikes, things slow down, some people suffer, but as a whole it's like a short fever and within a year or couple we get back on track.

The biggest recessions in between 1929-1933/1937 and 2008 were the Volcker shocks. Carter appointment Paul Volcker to run the Fed, and Reagan reappointed him. He made a really daring move and massively raised interest rates to stop runaway inflation started in Nixon's presidency. Those recessions saw stocks plummet, unemployment go above what we saw in the past few years. But they were short recessions followed by huge booms. This is because the recession was caused by and then fixed by the federal reserve.

The kind of recession that crashed America in 2008 got a bit tipped by the Fed raising rates, but was a financial crisis. This is the kind that hit America for the Great Depression. These are much, much, much worse. Without intervention they can take 20 years to escape (think the 1870s-1890s). Basically the financial system starts domino'ing, starts collapsing, and money gets caught up. There's a huge credit crunch, and businesses can't take out loans far worse than the other scenario. Companies fire employees, stop buying capital (which leads to other companies that sell capital to fail, losing more workers, etc). This makes a huge demand shortage, so there aren't enough people to buy to make future investments worthwhile. Worse still, cutting interest rates is not enough--even at 0% interest, it's safer to hold cash than to invest which creates jobs and gets the economy rolling.

So the economy gets stuck spiraling until it hits bottom. Bottom is when the firms' (factories, farms, service firms, it doesn't matter) capital starts breaking down and there is still enough demand to meet the current, diminished consumer base (think 80% employment with 80% wages rather than 100% and 100%, aka 2/3s the potential economy), THEN the firms start buying new capital which spurs the slow recovery.

Now, in a healthy economy we only want the government to hire/contract with workers for jobs the government should be doing--running public goods like schools or police forces or contracting private construction firms to build roads and court houses etc. This is because if we use the government to hire in a competitive market, we crowd out more efficient businesses.

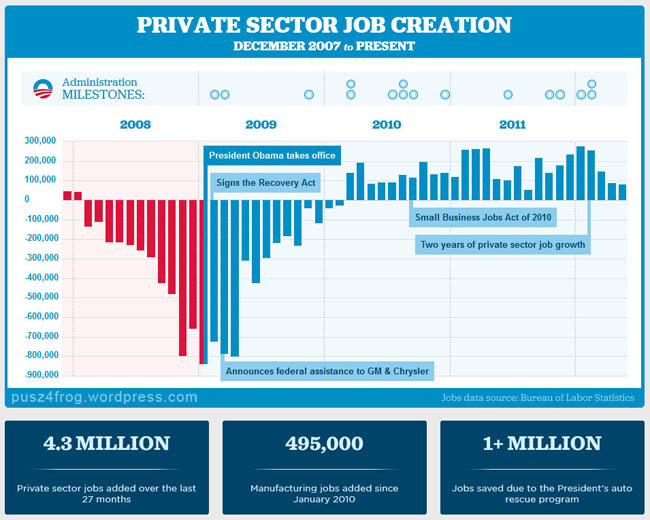

But in a demand shortage and liquidity trap, there's room for government to enter those markets because there is a shortage compared to equilibrium. In doing so, the government can get the economy rolling: unemployment insurance and direct hiring for projects (build dams, schools, roads, fiber optics, art projects, whatever makes places nicer or better or hell, you could literally even have them do useless things although that's a wasted opportunity) leads to two things: demand for capital by the government or firms the government pays to do this stuff, and money in the hands of those workers. Boom, demand is raised, investments come back, and the economy improves. Do enough of this stimulus and you end the problem. We nearly ended the Great Depression *before* world war two, and would have had we not freaked out about short term deficits and crashed the economy with austerity in 1937. But with WW2 we got the demand up to get the economy back. We didn't need that level of stimulus for the Reagan-era recessions because it was controlled, orchestrated recession. But we do again now, and the only way Obama could have been the one to fix it himself would be if congress had authorized him, instead of $800 billion in the first year, about $1.6 trillion. It would have saved us a lot of grief.

But instead we get to wait, thanks to gridlock. The amount of stimulus we already did made a big improvement than what would have happened, but politically it doesn't look good enough. Given current growth, it probably cut the length of recession from like 12 years to maybe 8. Mitt Romney's proposed policies aren't going to help the economy at all.

Ghostwriter said:I really don't know to be honest, I don't really have a good metric to use.

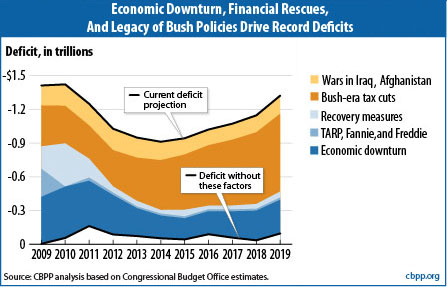

I do know that Obama has not been doing a whole lot of good for the economy and that the economy is still struggling. I know its fashionable to blame Bush but c'mon, he's been out for four years. Its fashionable to blame Bush for his two wars, but A: The Democrats voted for them too, and B: Obama could have pulled out of both a long time ago. This sounds nice, but it fails to understand economics--unless you blame Obama for Republicans in the Senate for failing to pass a better, bigger stimulus early on that would have prevented much of this.

Who really deserves the credit or blame for the economy? I know congress plays somewhat of a role but I don't know how much.

How can you say if you don't know how to measure the economy that Obama's been bad? You know what's more fashionable than blaming Bush? That saying he's had four years and so the economy should be perfect so since it's not, he's failed.

There are two main kinds of recessions in the fiat-currency world (i.e. non-gold backed currency): there's the interest rate recession and there's the financial crisis recession/depression.

Most every recession since WW2 has been an interest rate recession: the economy ran too hot, and the federal reserve, foreseeing problems, would raise interest rates until things cooled back to a strong equilibrium. During this process, weaker businesses would get pruned from the economy. Raising interest rates raise the cost of borrowing which slows down capital (like machines, land, the cost of labor's + education value etc) and hiring (just labor) which reduces firm output as well as consumer demand to buy the stuff. So unemployment spikes, things slow down, some people suffer, but as a whole it's like a short fever and within a year or couple we get back on track.

The biggest recessions in between 1929-1933/1937 and 2008 were the Volcker shocks. Carter appointment Paul Volcker to run the Fed, and Reagan reappointed him. He made a really daring move and massively raised interest rates to stop runaway inflation started in Nixon's presidency. Those recessions saw stocks plummet, unemployment go above what we saw in the past few years. But they were short recessions followed by huge booms. This is because the recession was caused by and then fixed by the federal reserve.

The kind of recession that crashed America in 2008 got a bit tipped by the Fed raising rates, but was a financial crisis. This is the kind that hit America for the Great Depression. These are much, much, much worse. Without intervention they can take 20 years to escape (think the 1870s-1890s). Basically the financial system starts domino'ing, starts collapsing, and money gets caught up. There's a huge credit crunch, and businesses can't take out loans far worse than the other scenario. Companies fire employees, stop buying capital (which leads to other companies that sell capital to fail, losing more workers, etc). This makes a huge demand shortage, so there aren't enough people to buy to make future investments worthwhile. Worse still, cutting interest rates is not enough--even at 0% interest, it's safer to hold cash than to invest which creates jobs and gets the economy rolling.

So the economy gets stuck spiraling until it hits bottom. Bottom is when the firms' (factories, farms, service firms, it doesn't matter) capital starts breaking down and there is still enough demand to meet the current, diminished consumer base (think 80% employment with 80% wages rather than 100% and 100%, aka 2/3s the potential economy), THEN the firms start buying new capital which spurs the slow recovery.

Now, in a healthy economy we only want the government to hire/contract with workers for jobs the government should be doing--running public goods like schools or police forces or contracting private construction firms to build roads and court houses etc. This is because if we use the government to hire in a competitive market, we crowd out more efficient businesses.

But in a demand shortage and liquidity trap, there's room for government to enter those markets because there is a shortage compared to equilibrium. In doing so, the government can get the economy rolling: unemployment insurance and direct hiring for projects (build dams, schools, roads, fiber optics, art projects, whatever makes places nicer or better or hell, you could literally even have them do useless things although that's a wasted opportunity) leads to two things: demand for capital by the government or firms the government pays to do this stuff, and money in the hands of those workers. Boom, demand is raised, investments come back, and the economy improves. Do enough of this stimulus and you end the problem. We nearly ended the Great Depression *before* world war two, and would have had we not freaked out about short term deficits and crashed the economy with austerity in 1937. But with WW2 we got the demand up to get the economy back. We didn't need that level of stimulus for the Reagan-era recessions because it was controlled, orchestrated recession. But we do again now, and the only way Obama could have been the one to fix it himself would be if congress had authorized him, instead of $800 billion in the first year, about $1.6 trillion. It would have saved us a lot of grief.

But instead we get to wait, thanks to gridlock. The amount of stimulus we already did made a big improvement than what would have happened, but politically it doesn't look good enough. Given current growth, it probably cut the length of recession from like 12 years to maybe 8. Mitt Romney's proposed policies aren't going to help the economy at all.

that I hadn't heard about until I misread their existence today.

that I hadn't heard about until I misread their existence today.