IBM releases first-ever 1,000-qubit quantum chip

IBM has unveiled the first quantum computer with more than 1,000 qubits — the equivalent of the digital bits in an ordinary computer. But the company says it will now shift gears and focus on making its machines more error-resistant rather than larger.

For years, IBM has been following a quantum-computing road map that roughly doubled the number of qubits every year. The chip unveiled on 4 December, called Condor, has 1,121 superconducting qubits arranged in a honeycomb pattern. It follows on from its other record-setting, bird-named machines, including a 127-qubit chip in 2021 and a 433-qubit one last year.

Quantum computers promise to perform certain computations that are beyond the reach of classical computers. They will do so by exploiting uniquely quantum phenomena such as entanglement and superposition, which allow multiple qubits to exist in multiple collective states at once.

But these quantum states are also notoriously fickle, and prone to error. Physicists have tried to get around this by coaxing several physical qubits — each encoded in a superconducting circuit, say, or an individual ion — to work together to represent one qubit of information, or ‘logical qubit’.

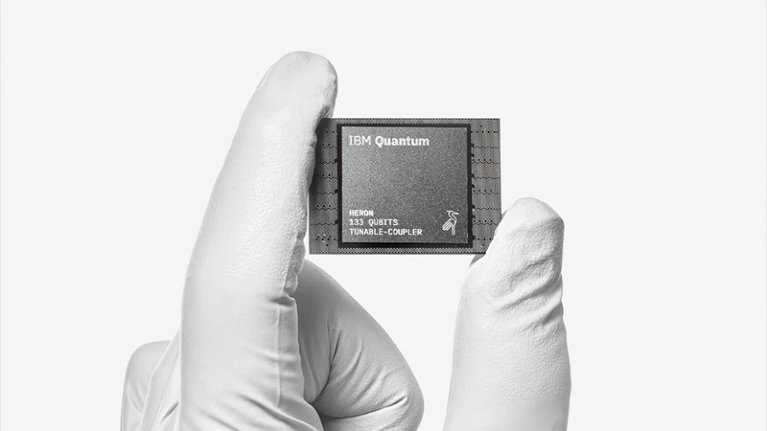

As part of its new tack, the company also unveiled a chip called Heron that has 133 qubits, but with a record-low error rate, three times lower than that of its previous quantum processor.

Researchers have generally said that state-of-the-art error-correction techniques will require more than 1,000 physical qubits for each logical qubit. A machine that can do useful computations would then need to have millions of physical qubits.

But in recent months, physicists have grown excited about an alternative error-correction scheme called quantum low-density parity check (qLDPC). It promises to cut that number by a factor of 10 or more, according to a preprint by IBM researchers1. The company says it will now focus on building chips designed to hold a few qLDPC-corrected qubits in just 400 or so physical qubits, and then networking those chips together.

The IBM preprint is “excellent theoretical work”, says Mikhail Lukin, a physicist at Harvard University in Cambridge, Massachusetts. “That being said, implementing this approach with superconducting qubits seem to be extremely challenging and it will likely take years before even a proof-of-concept experiment can be tried in this platform,” Lukin says. Lukin and his collaborators conducted similar study on the prospect to implement qLDPC using individual atoms instead of superconducting loops2.

The catch is that the qLDPC technique requires each qubit to be directly connected to at least six others. In typical superconducting chips, each qubit is connected only to two or three neighbours. But Oliver Dial, a condensed-matter physicist and chief technology officer of IBM Quantum, at IBM’s Thomas J. Watson Research Center in Yorktown Heights, New York, says that the company has a plan: it will add a layer to the design of its quantum chips, to allow the extra connections required by the qLDPC scheme.

A new IBM road map on the its quantum research unveiled today sees it reaching useful computations — such as simulating the workings of catalyst molecules — by decade’s end. “It’s always been the dream, and it’s always been a distant dream,” says Dial. “Actually having it come close enough that we can see the path from where we are today for me is enormous.”