Hygro

soundcloud.com/hygro/

It's as if economics can be applied generally.

That's like saying that when you turn on the tap in your bath tub, the water level will only rise directly below the tap and not 1 foot away.

Don't get me wrong, I think we have no choice but to save our money using financial instruments.Yeah I don't agree that it is an open-ended series of possibilities. There is one single end: what happens in aggregate to your money. El Mac, your argument tries to have it both ways: it says on one hand that investing in a hotdog stand increases the aggregate supply of hotdogs, but not that investing in the stock market increases the aggregate supply of capital to firms. If you're going to use an "in aggregate" argument for the hotdog stand then you should also use an "in aggregate" argument for the supply of capital (which obviously affects the cost of capital, and therefore the cost of borrowing, and therefore the propensity of firms to invest).

I was literally writing a reply that started with "is that not just an argument in favour of consumption over saving though?" I still don't understand how you square (a) your belief that basically all savings vehicles (including consumer banking products) are basically entirely rent-seeking with the idea that (b) there is not only value in saving but there is actually more value in saving than in consumption. (The way I square it is to reject (a).)Sorry for the multi-posting, l'esprit de l'escalier, or (more accurately), the spirit of the shower.

I don't want people to mistake the value of saving vs the value of consumption. The value of saving is so much greater, and it's why I enjoy money. Supply/Demand; saving means that you're not consuming stuff that could alternatively be used in our economy to increase future output. It's reducing the price of stuff that people like, given how much natural capital is embedded in so much of our consumption.

But all investment turns nothing into something. This is what I don't get. If a company raises some amount of dollars from the capital market, whether by issuing shares or by withholding dividends, and then invests that money in productive assets or labour, how is that not adding productive inventory from non-productive $? You're bringing forward the timeframe at which a productive asset is being purchased by a company, because the company doesn't have to wait until it has enough spare OpEx or cash to buy stuff. Companies do actually take their share price and investor return into account when making investment decisions. Companies do actually make the argument to shareholders that, by withholding a dividend, they can deliver a greater return in the future. And if you buy on that basis then you're giving them the go-ahead to do that. It really does happen! I understand that this doesn't feel as direct an impact as buying a hotdog stand and selling something tangible, but that's just how modern economies are now. They just aren't as viscerally connected as we humans are capable of intuiting, but they do in fact do something productive. When you buy a company's stocks, this really does impact investment decisions. When you add money to the stock market, you really do make companies invest more in productive assets.I want to go back to first order, and my insistence that we don't know what the recipient of the capital will do with it. That's on them, not on us. It's a different conversation. The big difference in the hotdog stand and the house (waiving away my brainfart regarding short-term housing) would be that the hotdog stand is turning idle inventory into productive inventory, or (at least) trying to. Ostensibly, the price of the hotdog stand will just keep falling in price until the inventory clears, so buying it now (instead of someone else later) affects the timeframe at which the stand is brought online. It's not so much increasing the aggregate demand for hotdog stands, but actually increasing the supply of hot dogs. It's why I changed my mind on the housing, because my first instinct was that it was not increasing the supply of housing. But it is, in that it increases the supply of transient housing.

My view is that saving ought to be discouraged by economic policy, and indeed I envision an economy in which saving is no longer a good choice even from the perspective of an individual.

In the past savings had an investment function. They do not anymore, so saving represents the deferral of present consumption for....nothing.

My view is that saving ought to be discouraged by economic policy, and indeed I envision an economy in which saving is no longer a good choice even from the perspective of an individual.

In the past savings had an investment function. They do not anymore, so saving represents the deferral of present consumption for....nothing.

You are basically advocating a return to the old Malthusian economy where close to 100% of output was eaten and there was no real accumulation of technology or capital per capita in the long run. To me this sounds like a terrible idea, to hold back the whole world for the sake of punishing your ideological enemies, the well off.

Getting to a system where savings are discouraged has a hell of a social cost. You would have to model exceptional returns on that cost.

Savings don't defer consumption for nothing. We use them to purchase financial assets.

Companies do actually make the argument to shareholders that, by withholding a dividend, they can deliver a greater return in the future.

For this lack of shared prosperity, the allocation of corporate profits to stock buybacks bears considerable blame. From 2003 through 2012, 449 S&P 500 companies dispensed 54% of earnings, equal to $2.4 trillion, buying back their own stock, almost all through open-market repurchases. Dividends absorbed an additional 37% of earnings. Scant profits remained for investment in productive capabilities or higher incomes for hard-working, loyal employees.

You're conflating analysis from the perspective of an individual with analysis from the perspective of the aggregate.

Savings have no investment function anymore because in the early 20th century technology advanced to the point that you no longer need to increase the capital stock to increase production. Indeed, productive processes became so efficient that increasing productivity and increasing production could actually happen at the same time as absolute decreases in the capital stock. Net investment in new capital has been falling since the 1920s yet this situation is accompanied by massive increases in production and productive capacity. Why? Think of how a factory full of robots can do the work of ten factories full of people. Look at how manufacturing employment in the US has dropped like a rock even as manufacturing output has increased steadily.

So this is the fundamental problem with much economic policy and discourse today. All our intuitions and folk knowledge come from an era in which increased production in the future required deferred consumption today. With this no longer the case, policies that are designed to grow the economy by inducing people to save inevitably backfire. The financial wealth created just goes to inflate a bubble rather than producing anything real. The bubble collapses and the workers don't have enough money to consume what they produce. This dynamic has occurred repeatedly since the end of the 1920s, with only a small break from the end of WW2 to roughly the mid-70s, where the financial sector was regulated tightly enough that bubbles didn't get out of hand. There was also an enormous array of institutions, policies, and so on designed to prevent inequality from getting out of hand (thus ensuring that workers could consume most or all of what they produced).

So, @ls612, I am certainly not advocating a return to the "Malthusian" economy. I'm advocating a recognition that the economy today is driven fundamentally by consumption rather than by saving. Consumption is the the driver of production because an investment in production will be "successful" only if people end up actually having enough money to consume what is produced. And if people aren't consuming, capitalists will respond by not producing.

While this sounds great it is dead wrong. First of all, the capital stock in the United States has increased every year since 1950,

This blue line on the graph shows gross investment by private domestic firms, while the red line shows net investment by private firms, both divided by GDP. You can see that from the 1970s and up into the 1990s, high levels of gross investment exceeded 14% of GDP. But since 2000, high levels of gross investment don't reach 14% of GDP. Interestingly, the drop-off in investment seems more visible in the red line showing net investment.

In the next figure, net domestic investment by private domestic firms is divided by gross investment: in effect, this calculation shows what percentage of total investment is actually adding to the capital stock, rather than just replacing earlier investments that have depreciated. The striking pattern is that from the 1960s up to the early 1980s, it was common for about 40% or more of total investment to be "net" or new investment. But since about 2000, it's been common for about 20% of total investment to be "net" or new investment, while the other 80% is replacing older capital stock.

The decline in investment is bothersome in a number of ways. Investment in physical capital is one of the factors that over time raises productivity and wages. It's a little troublesome that 80% of gross investment is going to replace old capital, rather than add to the capital stock. And low investment is at the root of concerns about the possibility of "secular stagnation," which is a worry that the economy is headed for a slow-growth future because investment spending is likely to remain low.

Ahem. Accumulation of capital happens insofar as any increase in goods production and labor productivity—in a word, growth—requires net additions to the capital stock and the labor force, as in the period 1800-1920. Disaccumulation happens when economic growth occurs without these additions, and indeed proceeds as a function of declining net investment, as in the period 1920-present. There, I said it.

Declining net investment? How so? Gross investment is composed of replacement and maintenance of the existing capital stock, plus net additions to the capital stock. Disaccumulation happens when the mere replacement and maintenance of that capital stock is sufficient to fuel economic growth on an astonishing scale.

Now, the implications are pretty weird. On the one hand, human labor is extricated from the goods-productions process. The horizon of socially necessary labor recedes, and the class position once enacted by the industrial proletariat becomes increasingly difficult to articulate. So class consciousness gives way to other forms of identity in the 1920s and after. On the other hand, the deferral of consumption, which presupposes increased savings, is no longer the condition of increased production—of growth. Consumption now becomes the condition of growth because net investment becomes unnecessary.

And so the deferral of gratification—saving for a rainy day—leads to economic crisis. Uh oh. As Stuart Chase exclaimed in 1934, “a whole moral fabric is thus rent and torn.”

This addition of $45 trillion to the stock of capital in the united states by definition didn't come from consumption. It came from years and years of savings and investment,

Second, you seem to ignore another destination for savings; research and development.

Financial bubbles happen when too many dollars find too few good homes.

This was the case in the early 2000s when a ton of foreign capital was moving to the US in response to a weak dollar and the result was a housing bubble, but when the US has good homes for 2-3 trillion dollars per year (and this isn't including paying for depreciation, which is another several hundred billion), an aggregate savings rate of 20% is far more appropriate than an aggregate savings rate of 0.

) team scores; you know, a player getting paid millions of euros/pounds. For him it makes perfect sense to care. For his supporters... not so much.

) team scores; you know, a player getting paid millions of euros/pounds. For him it makes perfect sense to care. For his supporters... not so much.Yeah, it's not like I am saying that consumption is superior to saving. But to square a with b, I am not saying that all savings vehicles are rent-seeking, but that they're best expressed as 'savings' and not 'investments'. But a lot of my usage of this language is because I really want to increase people's understanding of the supply-side opportunities for investment (a filling now saves a root canal later, you can outright model this as "spending that decreases future costs")I was literally writing a reply that started with "is that not just an argument in favour of consumption over saving though?" I still don't understand how you square (a) your belief that basically all savings vehicles (including consumer banking products) are basically entirely rent-seeking with the idea that (b) there is not only value in saving but there is actually more value in saving than in consumption. (The way I square it is to reject (a).)

First I'm going to talk first about the article itself. Then I'm going to answer your question directly, because I do have actual examples of this happening, it is not an uncommon phenomenon, and it is a decision made by companies literally all the time.I would be curious as to whether you have any actual examples of this happening.

https://www.ineteconomics.org/uploa...lliam_Profits-without-Prosperity-20140406.pdf

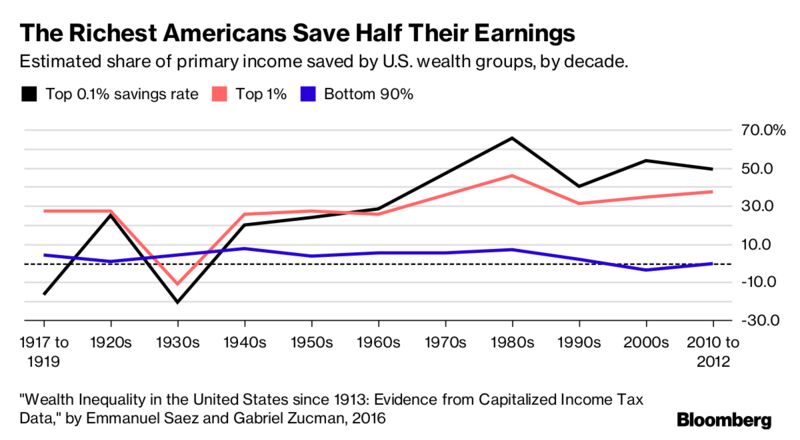

This is one of my favorite papers to cite because it's an illustration of what I'm talking about above. Giving money to rich people doesn't make them invest in anything, it makes them give themselves more money. If you want rich people to invest in things, you have to give the poor people money so they can buy the things the rich will then invest in producing.

So there you have it. This is what corporations actually use profits for. Given that only about 9% of corporate profits are left over from stock buybacks and dividends, I have to say that I don't think this phenomenon of corporations arguing that not doing a dividend now will result in greater returns later is particularly common or important. I know this data is from the US but I would be pretty surprised if the situation in the UK or elsewhere were very different.

Secondly, nobody here is going to defend Regan-era deregulation, or say that regulation doesn't skew what corporations decide to do with their earnings. I have no idea whether the author's argument is true or not; if it is then of course I agree with it. I assume that there are also tax reasons why corporations are buying back stock rather than issuing dividends; I assume it is more beneficial both to the company and to the shareholder. Obviously I am in favour of taxing rich people more and getting rid of these distortions.

Question

[...]

People who work in big corporations and make these decisions would much rather invest than give money back to shareholders. It's just much more exciting.

I feel like you think I'm talking theoretically, when in fact I'm basing it on my own experiences.

Thirdly, the %s are, in my opinion, not a useful metric for looking at stock buybacks or dividends vs retained earnings, because they're using total net profit over the period instead of ignoring loss-making companies/years. For example, let's say there are 9 companies that earn $10m and pay out $1m in dividends in that year. Then, there is a 10th company that makes a $50m loss and pays no dividend. On the authors' calculation, adding up the total dividend payments and dividing by the total net profit gives you a dividend ratio of 9/40 = 22.5%, even though no company ever paid out dividends greater than 10%.

A corollary of this is that you can't simply assume that the % of earnings retained by the company is 100% - dividend% - buyback%. In the above example, retained earnings add up to $81m, which is 202.5% of total net profit in that year. You can see why the authors did the calculation this way -- since they are only interested in the fact that share buybacks go up and dividends go down over the period, they don't need to worry about reconciling the total retained earnings. They just need to look year-on-year at the two ratios and compare them. This is a much easier calculation and all the data is readily available, so they just went with that. But you can't then draw conclusions about retained earnings.

I believe their point about "scant profit remaining for investment or wages" is in error, but it appears the vast majority of the article is simply about share buybacks, rather than drawing a causal link between share buybacks and wage growth or investment. Indeed, during the pre-crisis, post-Dot Com bust period they're talking about, CapEx spend was abnormally high throughout. Hard to see how they can argue that there was less retained earnings for investment during a period famous for enormous growth in CapEx!

I am wondering just how big a percentage of the actual american public has stocks on the Dow Jones. Or if cheering or caring about how that does is somewhat similar to how hooligans with no job cheer when some player in their football (soccer) team scores; you know, a player getting paid millions of euros/pounds. For him it makes perfect sense to care. For his supporters... not so much.

The top 20% also pays 84% of income taxes. Coincidence?10% of americans own 84% of the market.

http://time.com/money/5054009/stock-ownership-10-percent-richest/

The top 20% also pays 84% of income taxes. Coincidence?

https://www.wsj.com/articles/top-20-of-earners-pay-84-of-income-tax-1428674384

J

But, how do you explain the 84% in each case? Coincidence?I would have to say yes since capital gains tax rates are a lot lower than income tax rates and 10% doesn't equal 20%. I don't really know what you're getting at but they seem to have no correlation.

And it was just an observation not an opinion. Rich people have higher incomes and thus pay more taxes. Rich people also have more disposable income to buy stock. Makes sense to me.

Of course

Of course here, just

here, just