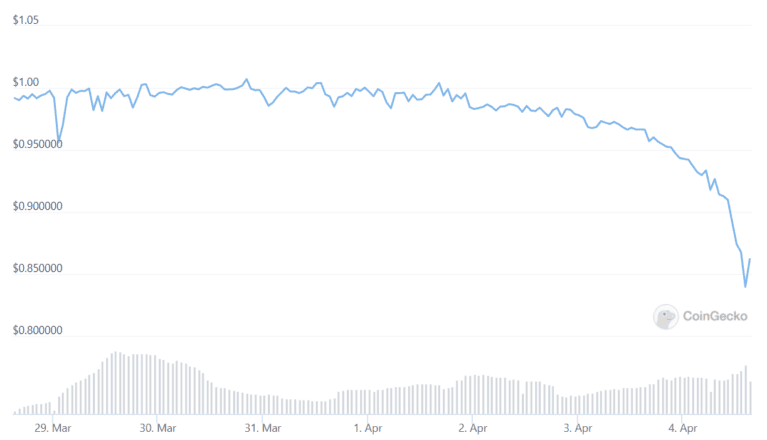

Stable coin not so stable

- The flagship stablecoin of the Waves network, Neutrino USD, has depegged after rumors of "death spiral" risks began circulating on Twitter.

- USDN is currently trading around the $0.86 price mark.

- The WAVES token has lost over 30% or $1.8 billion in value over the last four days.

Neutrino USD, the flagship stablecoin of the Waves ecosystem, is seeing its peg challenged amid short selling pressure on the ecosystem’s native token, WAVES. Neutrino USD (ticker: USDN) is meant to roughly follow the price of the U.S. dollar, but it’s currently worth around $0.86.

USDN lost its desired $1 peg last Friday after a scathing post by the pseudonymous crypto investor 0xHamZ began making rounds on Twitter. 0xHamZ

called WAVES, the native token of the Waves network, the “biggest ponzi in crypto,” and claimed that the project’s founders had been artificially pumping the token’s value using leverage.

WAVES is the biggest ponzi in crypto

It has recklessly engineered price spikes by borrowing USDC at 35% to buy its own token

Continuous WAVES market cap growth is needed to keep the system stable

WAVES will eventually crash and USDN will break with it

You're on notice

— 0xHamZ (@0xHamz) March 31, 2022

Waves began making headlines in March after seeing its market capitalization surge almost sixfold in just over a month amid otherwise relatively shaky market conditions. Its principal use case is to mint and support USDN, which has likewise seen its market capitalization surge from around $500 million to an all-time high of over $960 million over the same period before losing around $130 million in value today.

USDN’s mechanism works similarly to

MakerDAO‘s DAI, only it is overcollateralized and can only be minted using the WAVES token. The surging demand for USDN could be attributed to the large staking yields offered for the stablecoin on various DeFi platforms in the project’s ecosystem. However, 0xHamZ said that the high USDN staking yields were heavily dependent on the continuous growth of the collateral token, WAVES, and that the team had been “

folding leverage” to engineer a supply squeeze to pump WAVES’ price artificially.

They also

shared on-chain data to substantiate their claim, showing that the Waves team had been depositing USDN on the Waves-native money market protocol Vires Finance to borrow USDC, transferring the USDC to Binance to buy WAVES, and converting WAVES to USDN. The data showed that they repeated this process multiple times.

If you think this is just a minor coin that is having teething troubles, you may be interested in this video about the biggest coin: