Economic estimation of Bitcoin mining’s climate damages demonstrates closer resemblance to digital crude than digital gold

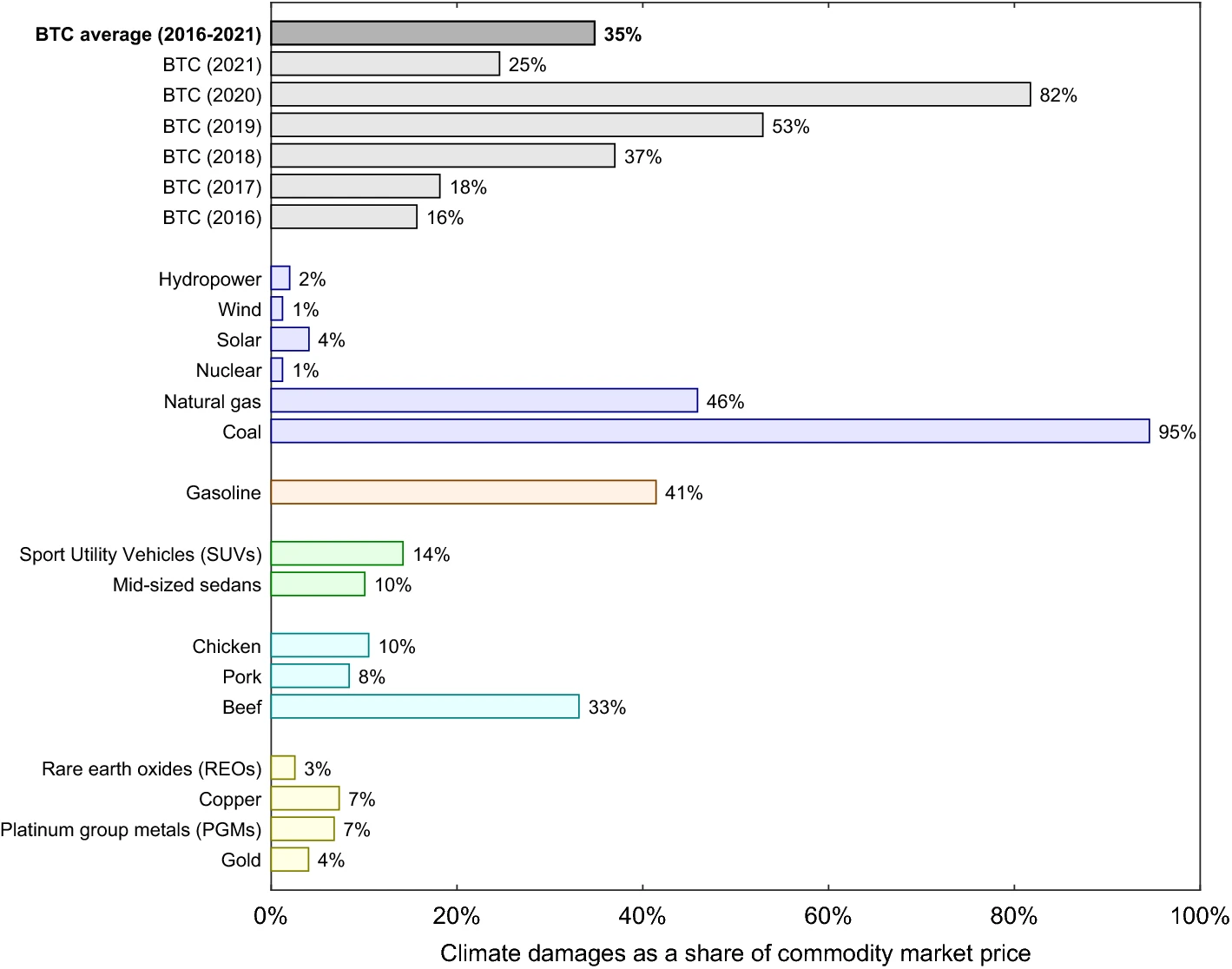

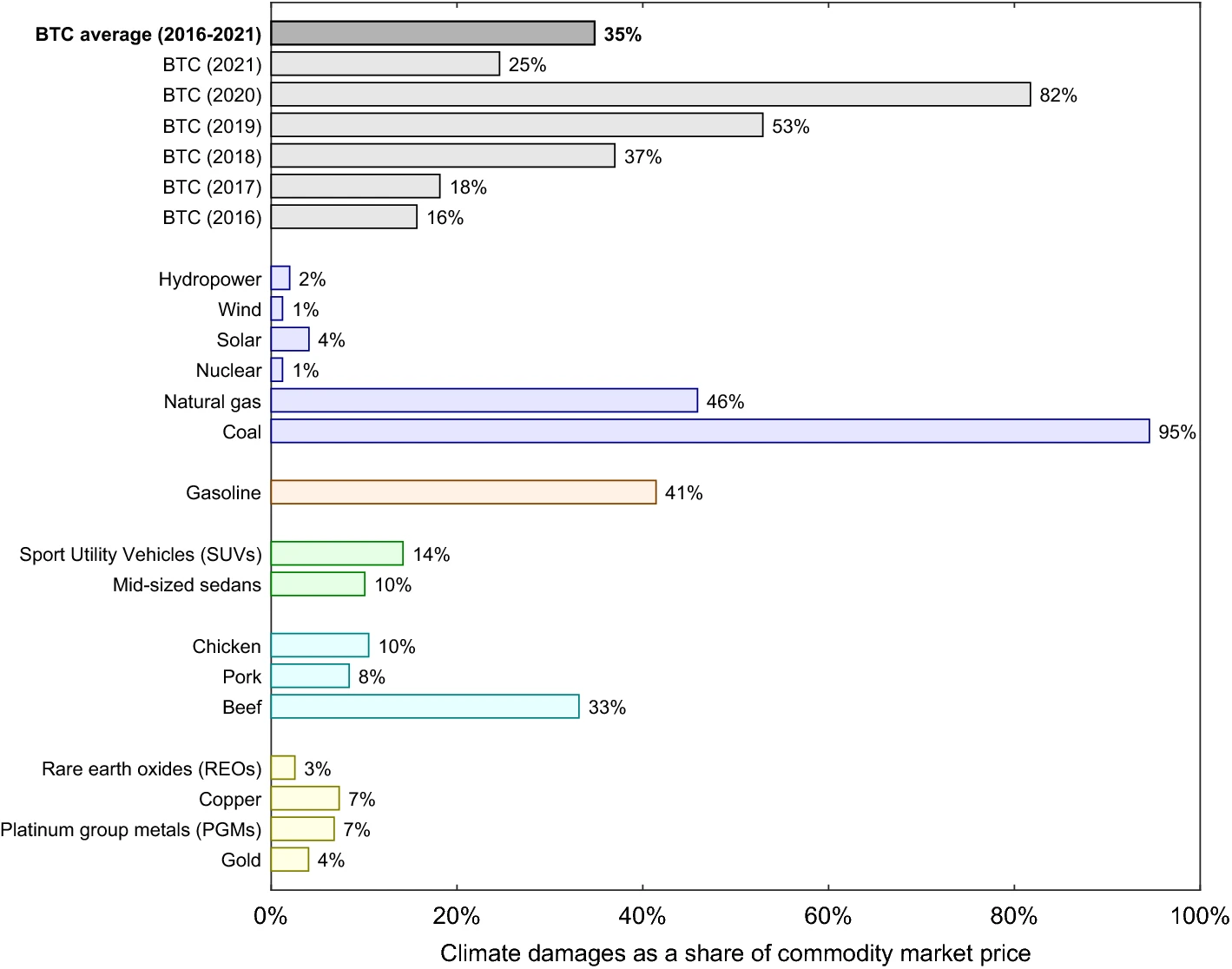

This paper provides economic estimates of the energy-related climate damages of mining Bitcoin (BTC), the dominant proof-of-work cryptocurrency. We provide three sustainability criteria for signaling when the climate damages may be unsustainable. BTC mining fails all three. We find that for 2016–2021: (i) per coin climate damages from BTC were increasing, rather than decreasing with industry maturation; (ii) during certain time periods, BTC climate damages exceed the price of each coin created; (iii) on average, each $1 in BTC market value created was responsible for $0.35 in global climate damages, which as a share of market value is in the range between beef production and crude oil burned as gasoline, and an order-of-magnitude higher than wind and solar power. Taken together, these results represent a set of sustainability red flags. While proponents have offered BTC as representing “digital gold,” from a climate damages perspective it operates more like “digital crude”.

Spoiler Legend :

Bitcoin (BTC) mining’s climate damages as a share of coin market price (2016–2021), compared with full lifecycle analysis climate damages as a share of market price for other commodities (for a single year). Damages are expressed in percentage terms (% of market price). BTC climate damages only include energy use and emissions from running mining rigs, and do not include climate damages associated with cooling and manufacturing of mining rigs or other potential sources of carbon equivalent emissions. This makes estimated BTC damages a lower bound compared to the full lifecycle damages for the other commodities shown. Climate damages for the other commodities and economic products shown are calculated using lifecycle estimates from the peer-reviewed literature and US government agencies combined with publicly available price data. All commodity prices and lifecycle climate damage data are in the Supplementary Data.