First quantum computer to pack 100 qubits enters crowded race

IBM’s newest quantum-computing chip, revealed on 15 November, established a milestone of sorts: it packs in 127 quantum bits (qubits), making it the first such device to reach 3 digits. But the achievement is only one step in an aggressive agenda boosted by billions of dollars in investments across the industry.

The ‘Eagle’ chip is a step towards IBM’s goal of creating a 433-qubit quantum processor next year, followed by one with 1,121 qubits, named Condor, by 2023.

Dealing with errors is particularly difficult, because the laws of physics prevent quantum computers from using the error-correcting methods of classical machines, which typically require keeping multiple copies of each bit.

Instead, researchers aim to build ‘logical qubits’ — in which almost all errors can be identified and corrected — from complicated arrangements of many physical qubits. The procedures so far proposed typically demand that each logical qubit contain around 1,000 physical qubits, although that ratio depends on the intrinsic fidelity — the error-resistance — of the physical qubits, says Dzurak.

IonQ co-founder Christopher Monroe, a physicist at the University of Maryland, and his co-workers last month reported a fault-tolerant logical qubit made from just 13 trapped-ion qubits, although Dzurak says that its degree of error-correction was “still quite some way from what is needed for a useful quantum computer, which needs logical error rates well below one in a million”.

The Google team, meanwhile, has achieved similar logical error rates using 21 superconducting qubits: again, “an important result”, says Dzurak, but still far from what is needed to crack the error-correction problem.

I think you need about 1,000 qubits to find the private key of a bitcoin wallet. So it all depends on the error handling, but with the frequency of news in this field I would not bet on it being a long time, and that is what you are doing if you use bitcoin as a store of value or speculative instrument.

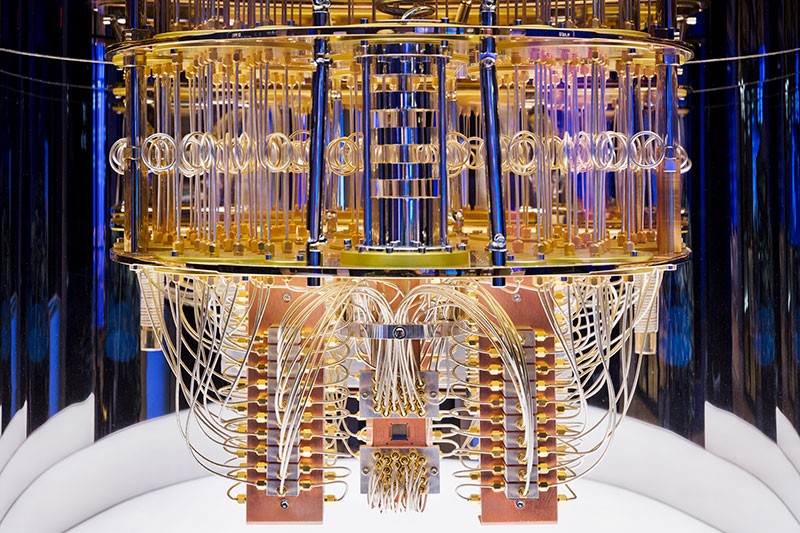

The innards of an IBM quantum computer show the tangle of cables used to control and read out its qubits. Kind of a pretty computer really. I wonder if that was a design consideration.