Updated at 10.03am BST

2h ago12:43

Ana Andrade, research analyst at

The Economist Intelligence Unit, reckons the eurozone economy still needs support - so don’t expect the European Central Bank to raise interest rates anytime soon!

She writes:

At the ECB’s last meeting Mario Draghi showed that the bank’s toolkit could be adjusted to tackle a potential severe economic downturn. The ECB signalled it was ready to go “low for longer” or even further cut rates if the euro zone headed into a recession. If the flash estimate for Q1 is confirmed at 0.4% there should be no need for this.

Nevertheless, we continue to expect TLTROs [new cheap loans to banks] in very favourable terms and no hike this year as inflationary pressures remain low.

Updated at 12.43pm BST

FacebookTwitter

2h ago12:32

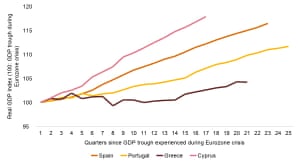

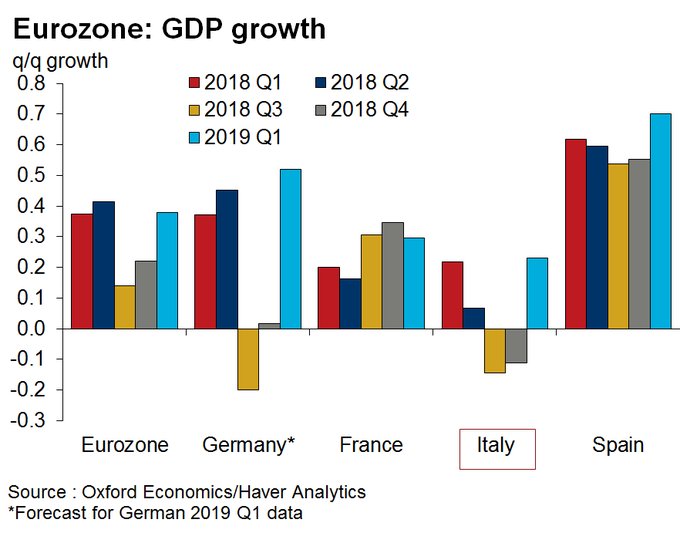

PwC have helpfully drawn up this chart, showing how Spain has posted a strong recovery since the debt crisis, but Greece has really struggled:

Photograph: PwC/Eurostat

Here’s Barret Kupelian, senior economist at PwC, on today’s growth data:

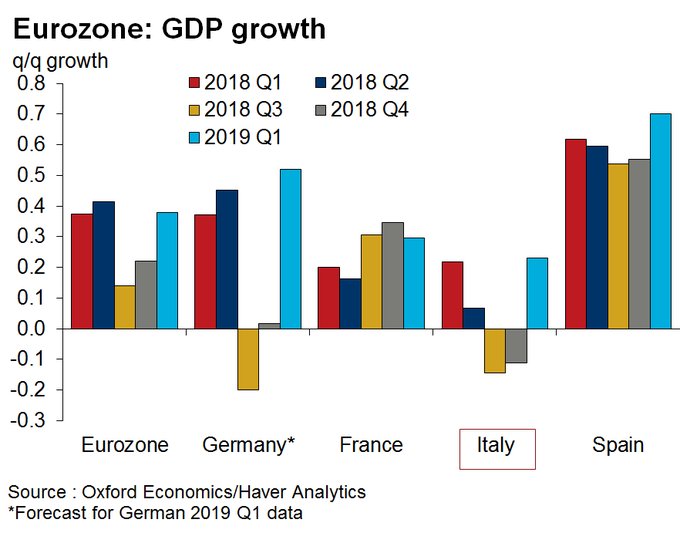

The national breakdown of the data showed the

Italian economy grew in the first quarter of this year putting an end to its 6th recession in the 21st century. For France, even though

output expanded by a respectable 0.3% on a quarter-on-quarter basis it was less strong than expected. However, we expect the recent tax cuts announced by the French authorities to sustain demand in the short-term, assuming households continue to spend rather than save.

Finally,

Spain continued to defy expectations growing at a rate of 0.7% quarter-on-quarter in line with its post Eurozone crisis average rate. The figure below shows that Spain’s GDP in level terms is now around 16% higher compared to the low it struck during the Eurozone crisis. This is the second best performance when compared to other peripheral economies, with sunny Cyprus managing to outperform others growing its economy by about 18%.

Does today’s data herald the beginning of a synchronised upswing in Eurozone GDP growth? It is probably too soon to tell with one quarter’s worth of data but Eurozone policymakers will be watching whether the momentum continues in the next few quarters.

FacebookTwitter

2h ago12:09

Nancy Curtin, CIO at

Close Brothers Asset Management, strikes a cautious note -- Europe’s economy is improving, but it’s hardly booming.

“Eurozone GDP figures may have provided a positive surprise for investors, but its economy is far from out of the woods. In reality, growth is still pretty anaemic, and the Eurozone’s export-led economy remains vulnerable to any global slowdown. But things are looking up; Chinese stimulus should turn into a tail wind for the region, supporting positive trends in wage growth and employment.

Should economic growth run out of steam once more, rather than picking up speed, a fiscal intervention or further monetary policy changes may be deemed necessary.“

FacebookTwitter

3h ago11:48

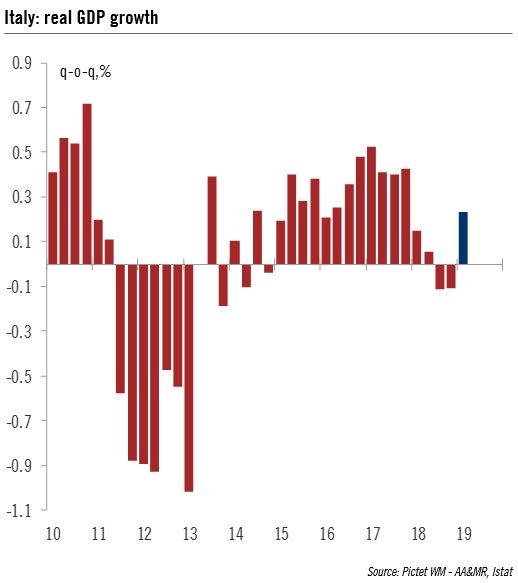

Italian GDP: What the experts say

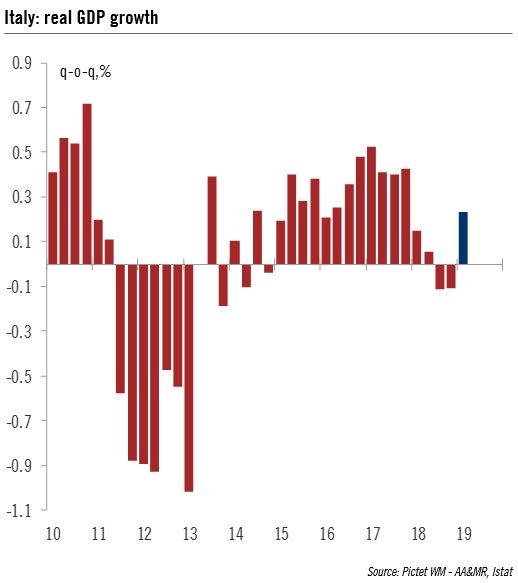

Pictet’s Nadia Gharbi points out that 2018 was a year to forget for Italy - at least 2019 has started better.

View image on Twitter

Nadia Gharbi@nghrbi

Italian GDP rose by 0.2% q-o-q in Q1, emerging from recession. This was the fastest GDP growth rate since Q4 2017. No GDP breakdown available (to be published on May 31).

Based on Istat info it seems that net exports contributed positively to GDP growth

9

12:45 PM - Apr 30, 2019

See Nadia Gharbi's other Tweets

Twitter Ads info and privacy

Nicola Nobile of Oxford

Economics makes an important point too; Italy has lagged sharply behind other Eurozone countries for some time.

View image on Twitter

nicola nobile@niconobivalgre

A decent data for Italian GDP: +0.2% in Q1 after recession in H2. But:

1) Istat said that Domestic demand was a drag on growth for the third consecutive quarter,

2) Italy remains the laggard among the eurozone countries..

8

12:23 PM - Apr 30, 2019

See nicola nobile's other Tweets

Twitter Ads info and privacy

FacebookTwitter

3h ago11:19

Italy’s farms, factories and service sector companies all made a positive contribution to growth in the last quarter, Istat says.

Net exports also boosted growth, which is an encouraging signal.

However, company inventories dragged back domestic growth (implying that firms ran down their stockpiles of goods).

Updated at 11.24am BST

FacebookTwitter

3h ago11:15

Italy escapes recession, but growth still weak

A rainbow shines over Rome’s skyline. Photograph: Gregorio Borgia/AP

In another boost to the eurozone, Italy has returned to growth after its third recession in a decades.

Italian GDP expanded by 0.2% in the first three months of this year, Istat reports.

That follows a 0.1% contraction in both the third and fourth quarters of 2018.

This pick-up in growth will cheer spirits in Rome, where the anti-establishment government has been struggling to deliver tax and spending changes following its dispute with Brussels over this year’s budget.

But the long-term picture for Italy still isn’t great -- the economy is only 0.1% larger than a year ago, meaning it still looks like the sickest member of the EU.

View image on Twitter

BelugTrade@BelugTrade

Italy Q1 preliminary GDP +0.2% vs +0.1% q/q expected

http://dlvr.it/R3mylW

12:04 PM - Apr 30, 2019

See BelugTrade's other Tweets

Twitter Ads info and privacy

FacebookTwitter

3h ago11:03

Newsflash: Italy has escaped recession! More to follow....

FacebookTwitter

3h ago11:00

Europe’s economy has been through some tough times recently, thanks to Brexit, the US-China trade war, political clashes between Italy and Brussels, and a downturn in Germany’s factory sector (particularly auto markets).

But today’s data suggests the eurozone will avoid being dragged into recession, as some feared.

Dan O’Brien, chief economist at the Institute of International and European Affairs, reckons the region is emerging from a soft patch.

View image on Twitter

Dan O'Brien@danobrien20

BREAKING

1) Short thread on European economic data published at 10am.

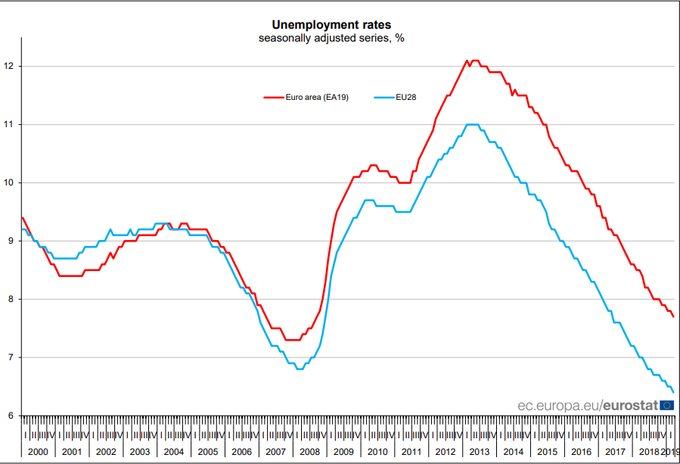

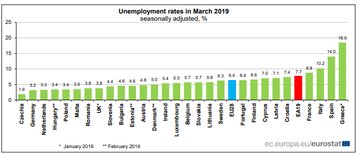

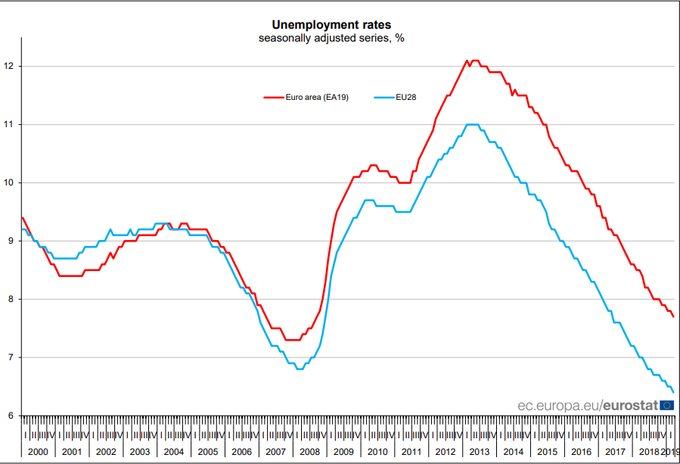

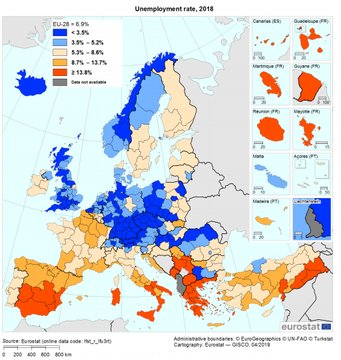

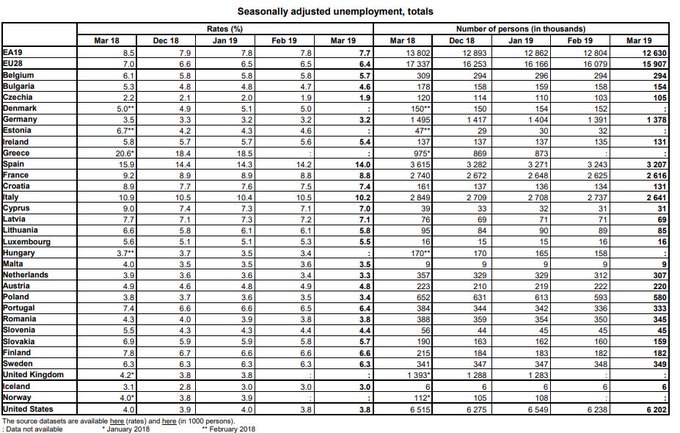

Despite the year-old economic slowdown, unemployment across the EU continues to fall and is closing in on 6% - a new 21st century low. Eurozone close to record low.

37

11:08 AM - Apr 30, 2019

39 people are talking about this

Twitter Ads info and privacy

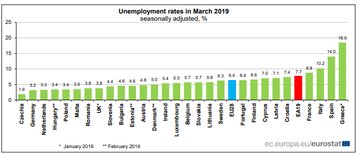

Dan O'Brien@danobrien20

Replying to @danobrien20

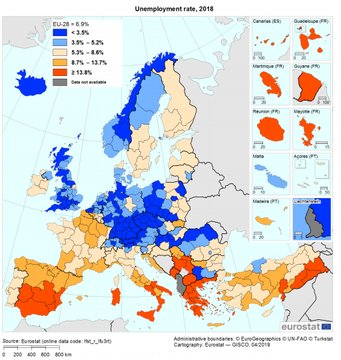

2) Unemployment varies a lot across the EU, even if it is trending downwards everywhere. As of early 2019, Greek joblessness still highest at 18.5% and Czech lowest at 1.9%.

Usual reminder, 13 countries have a lower rate than Ireland, so less of the 'full employment' talk please.

16

11:14 AM - Apr 30, 2019

See Dan O'Brien's other Tweets

Twitter Ads info and privacy

View image on Twitter

Dan O'Brien@danobrien20

Replying to @danobrien20

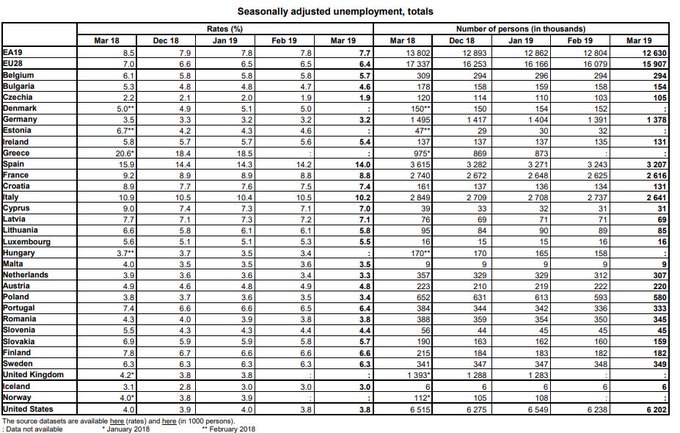

3) 16 million people unemployed across the EU as of March, compared to 6m in US. Spain's has the highest in absolute terms, at 3.2m, and second highest rate among the EU28 (14%).

Rates and raw numbers here by country

3

11:22 AM - Apr 30, 2019

See Dan O'Brien's other Tweets

Twitter Ads info and privacy

View image on Twitter

Dan O'Brien@danobrien20

Replying to @danobrien20

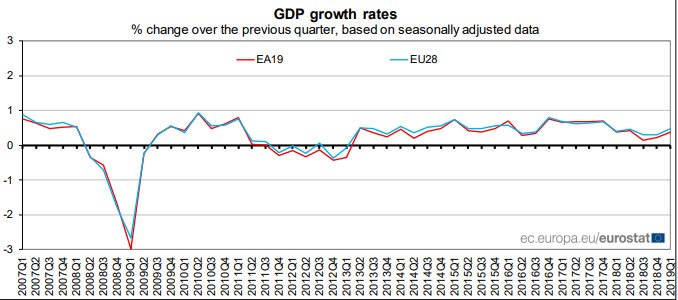

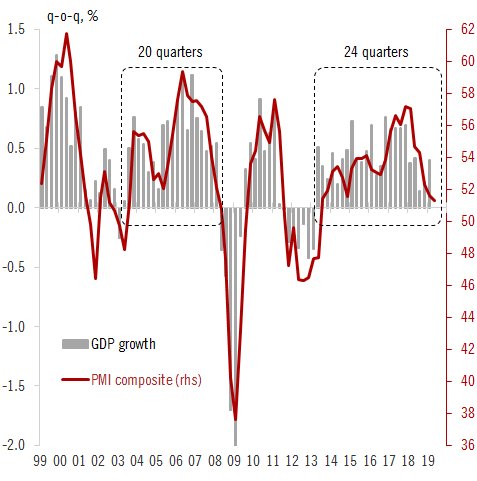

4) Also out today are GDP data for the first quarter of 2019, and they are pretty good.

Growth in both EU and eurozone accelerated, after slowing quite a bit in the second half of 2018. That is looking more like a soft patch than a slide into recession, but too early to be sure.

5

11:27 AM - Apr 30, 2019

See Dan O'Brien's other Tweets

Twitter Ads info and privacy

FacebookTwitter

4h ago10:47

Germany’s growth report won’t be issued for a couple of weeks. But today’s date implies that Europe’s largest economy has posted solid growth in the last quarter - perhaps 0.4%, or even faster?

Carsten Brzeski@carstenbrzeski

And judging from the available country data, Eurozone flash and monthly German data, my current estimate of 0.4% QoQ GDP for Germany in Q1 even looks somewhat pessimistic....

3

11:43 AM - Apr 30, 2019

Twitter Ads info and privacy

See Carsten Brzeski's other Tweets

FacebookTwitter

4h ago10:45

The euro has risen to its highest level in nearly a week, on the back of today’s jobs and growth figures.

The single currency has gained a third of a cent to $1.122, as investors conclude that the eurozone is stronger than thought.

BP PRIME UK@bpprimeuk

The Euro jumps above 1.12 (1.1213) against the US dollar soon after Eurozone better-than-expected macroeconomic data. Forex traders have come back to the "buy" side on

#EURUSD@graemewearden

11:12 AM - Apr 30, 2019

Twitter Ads info and privacy

See BP PRIME UK's other Tweets

Updated at 10.45am BST

FacebookTwitter

4h ago10:42

Unemployment across the wider European Union has fallen to 6.4% -- the lowest since Eurostat started keeping data in January 2000.

The statistics body says that almost one and a half million people stopped being unemployed in the last year:

Eurostat estimates that 15.907 million men and women in the EU28, of whom 12.630 million in the euro area, were unemployed in March 2019. Compared with February 2019, the number of persons unemployed decreased by 172 000 in the EU28 and by 174 000 in the euro area.

Compared with March 2018, unemployment fell by 1.430 million in the EU28 and by 1.172 million in the euro area.

FacebookTwitter

4h ago10:37

Eurozone unemployment hits 10-year low

In another boost, unemployment across the eurozone has hit its lowest level in over a decade.

The eurozone jobless rate fell to 7.7% in March, Eurostat reports. That’s down from 7.8% in February, and the lowest recorded since the financial crisis in September 2008.

It’s still rather higher than in the UK (3.9%) or the US (3.8%), but much better than the double-digit jobless rates recorded during the euro debt crisis.

Theres are, as ever, sharp differences across Euope.

The lowest unemployment rates in March 2019 were recorded in Czechia (1.9%), Germany (3.2%) and the Netherlands (3.3%). The highest unemployment rates were observed in Greece (18.5% in January 2019), Spain (14.0%) and Italy (10.2%).

Photograph: Eurostat

FacebookTwitter

4h ago10:23

Eurozone GDP: Snap reaction

Financial experts are welcoming the pick-up in eurozone growth in the last quarter.

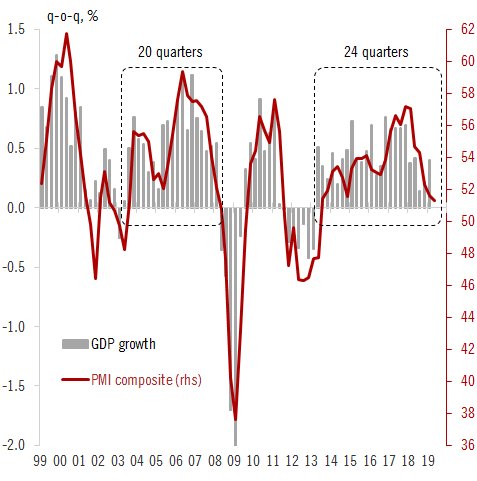

Fred Dukrozet of Swiss private bank

Pictet points out that the current recovery has now lasted six years:

View image on Twitter

Frederik Ducrozet@fwred

Bend, but not Break. Euro area real GDP up 0.4% QoQ in Q1, above expectations and much stronger than implied by PMIs.

We're 6 years into this uneven expansion cycle facing several headwinds and downside risks, yet much more resilient than before.

16

11:05 AM - Apr 30, 2019

19 people are talking about this

Twitter Ads info and privacy

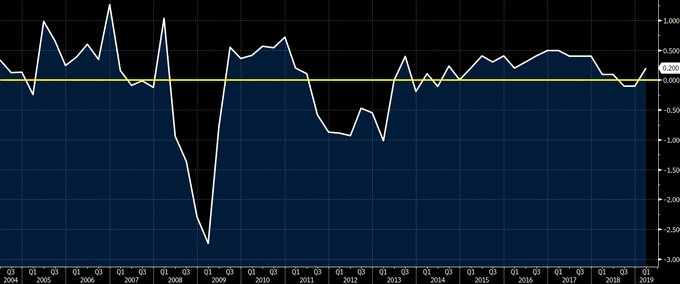

The Wall Street Journal’s Paul Hannon points out, though, that growth was still stronger in 2017.

Paul Hannon

✔@PaulHannon29

Replying to @PaulHannon29

The eurozone economy rebounded in the first three months of the year, and more strongly than had been expected. GDP was up 0.4%, double the prior rate of growth, an annualized 1.5%. So back to where it was in the first half of 2018, but nowhere near its 2017 peak.

11:02 AM - Apr 30, 2019

Twitter Ads info and privacy

See Paul Hannon's other Tweets

FacebookTwitter

4h ago10:11

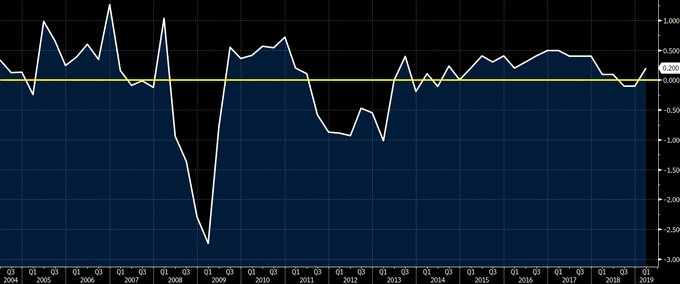

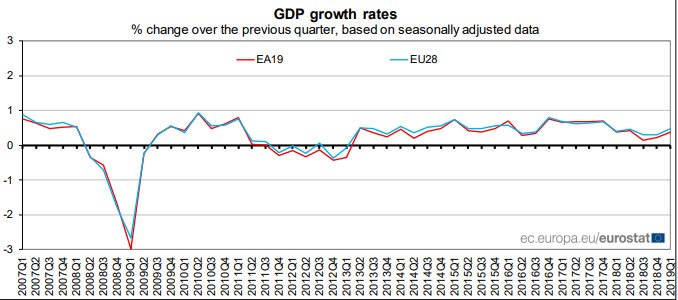

European policymakers will like the look of this chart - showing how growth is rising again after some tough quarters.

Photograph: Eurostat

FacebookTwitter

4h ago10:08

On an annual basis, the eurozone grew by 1.2% in the last year while the EU grew by 1.5%.

FacebookTwitter

4h ago10:07

The wider European Union also accelerated in the last quarter.

The EU grew by 0.5% in January-March, new figures from Eurostat show, up from 0.3% in the fourth quarter of 2018.