Tahuti

Writing Deity

- Joined

- Nov 17, 2005

- Messages

- 9,492

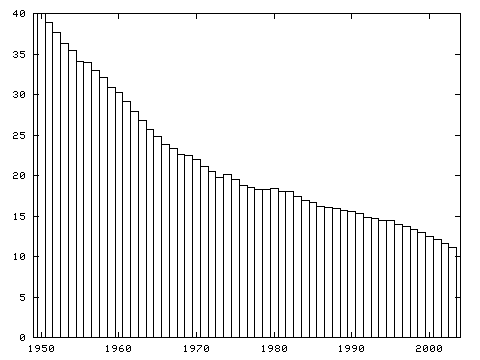

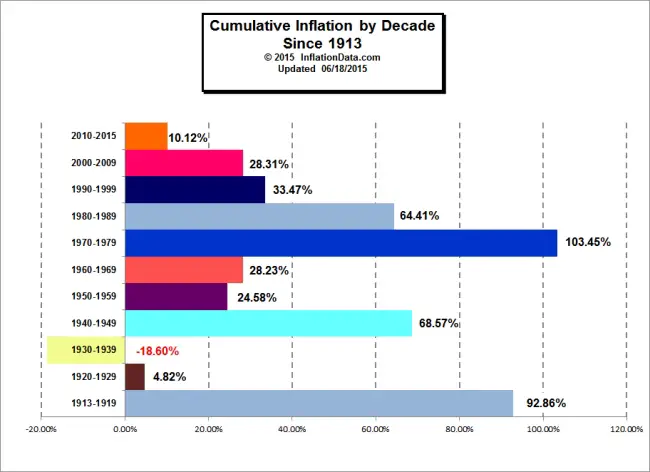

A lot of economists will be bound to be disgusted and inflamed by the view that deflation could actually be good. But what, if it actually is?

The common complaint against deflation is that it encourages unemployment and shrinking GDP, supposedly because deflation induces people to stop spending, in anticipation of lower prices. However, how about the possibility, that causal relation works differently, that deflation and unemployment have a common cause, but the former does not cause the latter? Deflation historically correlated with severe economic crises, but what if deflation only correlates with economic crisis, possibly as correction, instaed of causing it?

Another complaint is that deflation increases real-debt burdens. That's true, but what if that issue is overblown as well? In the light of the recent financial crisis, having a mechanism that punishes debtors may actually very well be a potent weapon in preventing yet another crisis. Banks are forced to lend out less, earn less profits, and become smaller in the process. Which is something everyone - save for the banks - would welcome.

Discuss.

The common complaint against deflation is that it encourages unemployment and shrinking GDP, supposedly because deflation induces people to stop spending, in anticipation of lower prices. However, how about the possibility, that causal relation works differently, that deflation and unemployment have a common cause, but the former does not cause the latter? Deflation historically correlated with severe economic crises, but what if deflation only correlates with economic crisis, possibly as correction, instaed of causing it?

Another complaint is that deflation increases real-debt burdens. That's true, but what if that issue is overblown as well? In the light of the recent financial crisis, having a mechanism that punishes debtors may actually very well be a potent weapon in preventing yet another crisis. Banks are forced to lend out less, earn less profits, and become smaller in the process. Which is something everyone - save for the banks - would welcome.

Discuss.