I do not think it has any multi level aspect, in that I cannot get you on it and make a little of the profit they make from you. All sorts of instruments that look like gambling, and requires no identification, so it is quite dodgy.I was referring to the poloniex link.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What are your thoughts on BitCoin?

- Thread starter aimeeandbeatles

- Start date

Behind the Bitcoin Bubble

WSJ said:To figure out if you’re in a bubble, you need to find the source of the hot air. Obvious for GameStop , but for bit-coin, not so much. In July 2018, we wrote about the cryptocurrency company Tether, which issues tokens called tethers that trade under the symbol USDT and should be valued at $1—making the currency a “stablecoin.” Tether’s creators might have manipulated bit-coin, a University of Texas paper suggests, by issuing tokens willy-nilly unbacked by real dollars and then buying bitcoin to jack up its price. (The company claims the research is flawed.) At the time, Tether’s total value was some $2.7 billion, and its website claimed: “Every tether is always backed 1to-1 by traditional currency held in our reserves.” So somewhere there should have been $2.7 billion in real money— that’s how a stablecoin is supposed to work. In November 2018, New York state Attorney General Letitia James invoked the Martin Act to begin an investigation into iFinex, which owns Tether and the Bitfinex cryptocurrency exchange, “in connection with ongoing activities that may have defrauded New York investors.” The company has disputed the attorney general’s claims, denied it misled customers, and said it will fight any action. An appellate court last year rejected its challenge to the probe.

Bitcoin peaked at the end of 2017 at $19,000 and over the next year collapsed to $3,200. Well—they’re baaack! On Friday Elon Musk was the latest to pump Bitcoin, which briefly reached almost $38,000. And there are now some $26.4 billion of USDT tokens, $18 billion of which were created since March 2020. Why the increase? No one has a good explanation.

All that glitters is not gold. In 2019 Tether subtly updated its claim to say reserves “may include other assets and receivables from loans made by Tether to third parties.” Tether has even admitted it only has 74% of the cash or cash equivalents to back its stablecoin. Hmmm. Basically unbacked.

In October 2019, a separate lawsuit was filed against Bitfinex claiming the exchange’s alleged market manipulation “likely surpasses $1.4 trillion,” which Bitfinex denies. Yes,

that’s trillion with a T. Bahamas- based Deltec Bank & Trust, where Tether has an account, recently claimed “every tether is backed by a reserve and their reserve is more than what is in circulation.” OK, but it turns out “reserves” may include an $850 million loan to Bitfinex. Is that the hot air? Oh, and reserves may include bitcoin too. Audit, anyone?

Pay no mind: “Momo” momentum investors dived in anyway. Bitcoin ran from $7,000 in January 2020 to almost $42,000 this Jan. 8. But the bit-coin bulls and bears are brawling. On Medium a few weeks ago, a poster named Crypto Anonymous (for what it’s worth, know your customer) did some digging and found that as much as two-thirds of bitcoin buys on any given day were purchased with tether, though crypto bulls insist that Chinese crypto investors use tether as a way to buy bitcoin. Try verifying that! The chart of bitcoin vs. tether issuance sure looks correlated, but a study published at the Center for Economic and Policy Research found no correlation. And I should note that wallet provider Coinbase, the largest holder of Bitcoin, says it “does not support USDT.” Do they know something?

Meanwhile, more than two years later, the New York attorney general’s office may get the documents it needs. I hope that includes an audit of Tether looking for the now $24.5 billion in cash, or even $19 billion if it’s 74% backed. I doubt all that cash exists. The attorney general claimed in a press release that some fishy money, maybe $850 million now part of Tether’s reserves, was taken from Tether to cover losses at Bitfinex. Yikes.

I contacted the attorney general’s office asking for the status of the investigation and what information it has received. I was pointed to the original filing for the scope of the investigation. It includes an accounting of all of Tether’s transactions. On Jan. 19, a letter from iFinex’s counsel said it had “largely completed the document production” and would “contact the Court in approximately 30 days” with a status update. So we’ll know something soon.

Manipulative actors have been known to take advantage of the madness of crowds.

Meanwhile, lo and behold, around the same time as that letter, Tether temporarily stopped creating any more currency. That might explain bitcoin’s quick mid-January price drop from $42,000 to under $30,000. If fraud is uncovered, look out below.

Normally I wouldn’t care. Bitcoin is nothing, it’s vapor, a concept of an idea. Transactions using bitcoin are few and far between. It’s not a store of value—anything that drops 30% in a week can’t play that role. But we get Bloomberg Wealth stories saying: “Newbie Bitcoin investors tell us what inspired them to buy at record prices.” A lot of folks who can’t afford it may get hurt badly. Robinhood curbed some crypto purchases on Friday.

So all crypto eyes are on mid-February. The power of the subpoena is strong. I have no insight into what New York’s attorney general will find. She might close the investigation and go on her merry way because there’s no crime, or uncover a fraud that could make Bernie Madoff look like he was stealing from a lemonade stand. We know what happens to bubbles when the hot air runs out.

Write to kessler@wsj.com .

INSIDE VIEW

By Andy Kessler

I am not sure I really "get" bitcoin, but I really do not get these stablecoins. You cannot use them to buy drugs, and you cannot use them for speculation, and you have to trust a single organisation. What good are they?Behind the Bitcoin Bubble

Also:

Coinbase is not on this list. It could be that they are holding it for others, but that is also something that I do not understand.Coinbase, the largest holder of Bitcoin

Last edited:

I tend to mostly read the headlines about crypto currencies since they are off my investment radar. I think it is a bizarro world mostly hidden behind hard to pull back curtains. A lucky few have likely made millions. It is an interesting phenomenon that will likely be influential in the future.

If you had loads, it may be in your own personal interest to invest a small amount in it. The thing is it is not a "risk that at some point the exchange rate will collapse", but a certainty. The question is when. If it is 100 years hence then you are probably OK, if it is tomorrow then you will lose your money now.I think bitcoin is a very promising currency. And if I had a lot of money, I would invest in it. I have read articles by many experts and everyone says that in the future it will grow. That next year it could reach 50K dollars. And this despite the fact that now it costs 20K. The profit is more than 2 times. Of course, there is a risk that at some point the exchange rate will collapse, and then people will lose a lot of money.

And the other thing is if you are investing in it you are providing price support, which encourages miners who are killing the planet.

If you had loads, it may be in your own personal interest to invest a small amount in it. The thing is it is not a "risk that at some point the exchange rate will collapse", but a certainty. The question is when. If it is 100 years hence then you are probably OK, if it is tomorrow then you will lose your money now.

And the other thing is if you are investing in it you are providing price support, which encourages miners who are killing the planet.

This is totally off the top of my head, but:

If you are investing in bitcoins, you may be helping the norks ICBM program.

As we have seen with Iran, a way of turning energy into money is crypto mining. North Korea has loads of coal, and selling it to China a significant source of foreign currency. That is being restricted. I bet they have mining farms running of power from dirty coal, and that is having a significant effect of their speed of their ICBM's.

Also, I found out about the Large Bitcoin Collider, which is looking for clashes along the lines of folding at home. I wonder if they have found no hits since they got 0.54 BTC in 2017-11-15 01:25:58 UTC, or if they started being more quiet about it.

If you are investing in bitcoins, you may be helping the norks ICBM program.

As we have seen with Iran, a way of turning energy into money is crypto mining. North Korea has loads of coal, and selling it to China a significant source of foreign currency. That is being restricted. I bet they have mining farms running of power from dirty coal, and that is having a significant effect of their speed of their ICBM's.

Also, I found out about the Large Bitcoin Collider, which is looking for clashes along the lines of folding at home. I wonder if they have found no hits since they got 0.54 BTC in 2017-11-15 01:25:58 UTC, or if they started being more quiet about it.

Last edited:

Quantum computers take another step towards breaking bitcoin

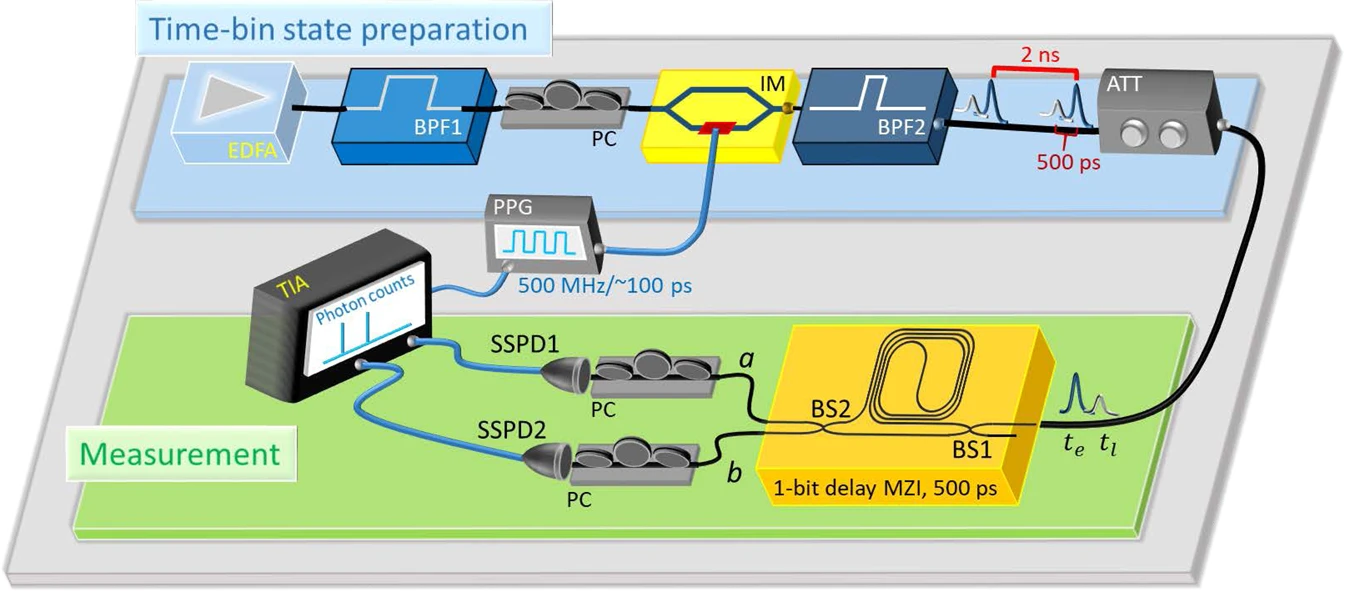

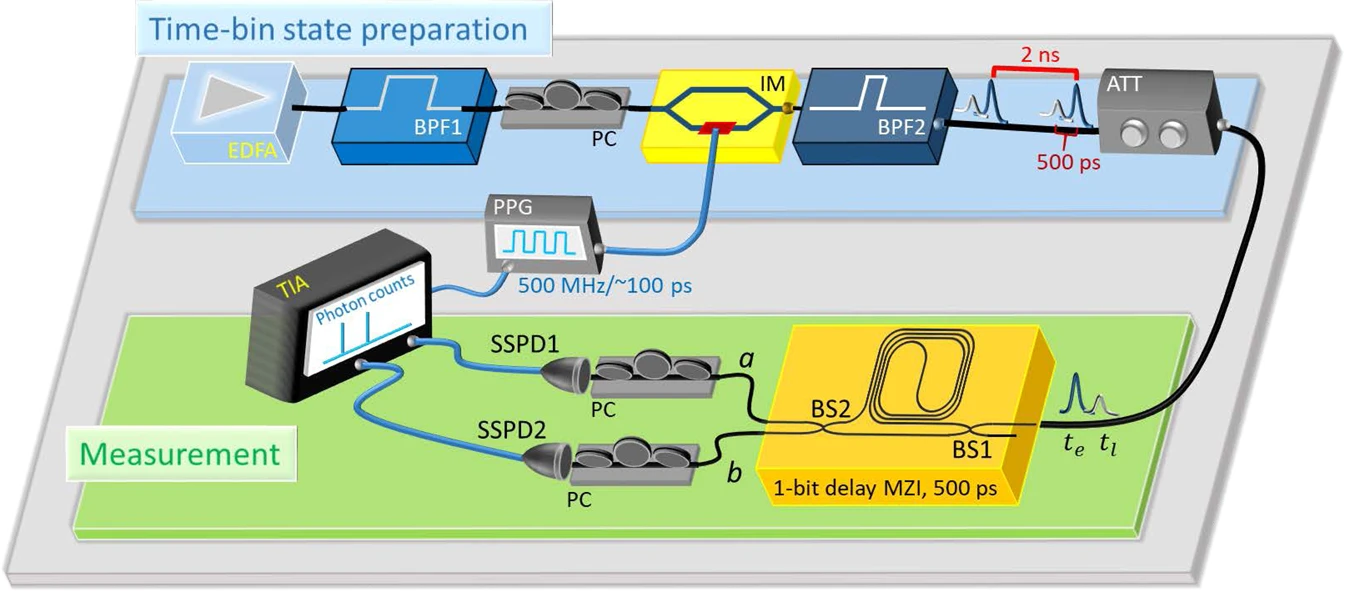

Researchers at the Japan's Nippon Telegraph and Telephone Corporation (NTT) claim they've invented the first high-speed quantum random number generator built on realistic quantum devices.

“In this work, by developing an efficient method for certifying randomness (a collaborative work with the researchers at the National Institute of Standards and Technology) and by measuring the arrival time of an optical pulse with time-bin encoding we show that every 0.1 seconds a block of 8192 quantum-safe random bits can be generated, enabling low-latency high-rate performance," the announcement explains. "Further, our scheme guarantees the practical security with realistic quantum devices."

Which matters because quantum computers are hard to scale because observing things in the quantum realm creates "noise" that has to be cancelled out to get computations done reliably. "Realistic" devices try account for the noise rather than take more drastic measures. The result is a less-complex, and therefore more practical, device.

This new invention is said to deliver random numbers without increasing latency. This matters because computers need random numbers for all manner of encryption and other tasks, and would rather not wait for a new entropy nugget to arrive.

“In this work, by developing an efficient method for certifying randomness (a collaborative work with the researchers at the National Institute of Standards and Technology) and by measuring the arrival time of an optical pulse with time-bin encoding we show that every 0.1 seconds a block of 8192 quantum-safe random bits can be generated, enabling low-latency high-rate performance," the announcement explains. "Further, our scheme guarantees the practical security with realistic quantum devices."

Which matters because quantum computers are hard to scale because observing things in the quantum realm creates "noise" that has to be cancelled out to get computations done reliably. "Realistic" devices try account for the noise rather than take more drastic measures. The result is a less-complex, and therefore more practical, device.

This new invention is said to deliver random numbers without increasing latency. This matters because computers need random numbers for all manner of encryption and other tasks, and would rather not wait for a new entropy nugget to arrive.

Paperyung.carl.jung

Hey Bird! I'm Morose & Lugubrious

So like three years ago I did some absolute basic google research on altcoins and bought the ones that appealed to me, just ended up throwing like 20-40 bucks at every one of them, and today that stack of Chainlink worth 20 buckaroos is now worth 700 euros, something like 850 dollars. People were saying that BitCoin/Altcoins were dead in this very thread long before that.

In the end crypto is really not a big mystery in terms of finance, it's just an incredibly volatile asset with very little actual use cases, but better returns than virtually anything in the world.. if you get lucky. For most it's just a loosing game, exactly like stocks. Free and fair markets were always just a fantasy. Big investors (and apparently republican politicians) get insider info and loose their bags before you do, and you end up sitting on them. Out of the 5 coins I invested in 2 ended up being a complete waste, 2 just didn't develop at all and one took off. Investing in Crypto really is not all that different from Penny stocks really.

I think it's patently obvious that BitCoin is super overvalued right now because of CoVid, I'd be looking to invest when BitCoin is back to the dumpster, like 20k max. Buying now is like buying when it first reached 20,000. I feel kinda similair about stocks, all of the ETFs I own are incredibly overvalued and are probably gonna drop soon.

In the end crypto is really not a big mystery in terms of finance, it's just an incredibly volatile asset with very little actual use cases, but better returns than virtually anything in the world.. if you get lucky. For most it's just a loosing game, exactly like stocks. Free and fair markets were always just a fantasy. Big investors (and apparently republican politicians) get insider info and loose their bags before you do, and you end up sitting on them. Out of the 5 coins I invested in 2 ended up being a complete waste, 2 just didn't develop at all and one took off. Investing in Crypto really is not all that different from Penny stocks really.

If you had loads, it may be in your own personal interest to invest a small amount in it. The thing is it is not a "risk that at some point the exchange rate will collapse", but a certainty. The question is when. If it is 100 years hence then you are probably OK, if it is tomorrow then you will lose your money now.

And the other thing is if you are investing in it you are providing price support, which encourages miners who are killing the planet.

I think it's patently obvious that BitCoin is super overvalued right now because of CoVid, I'd be looking to invest when BitCoin is back to the dumpster, like 20k max. Buying now is like buying when it first reached 20,000. I feel kinda similair about stocks, all of the ETFs I own are incredibly overvalued and are probably gonna drop soon.

The latest hot crypto product is NFT's. Somehow they seem to be even more pointless and environmentally damaging than bitcoin.

They are kind of like the pressed pennies of the crypto world. You use some ethereum cryptocoin and the hash of a digital file to make a "special" cryptocoin that you may be able to persuade other people is worth loads of money. People have managed this feat.

Pointless because there is no legal backing to their representation of ownership. I can make a NFT from any digital file, whether I have any rights to it or not. And they will not survive quantum computers.

I am not sure how they are so bad for the environment, as ethereum should be better than bitcoin, but the numbers quoted are spectacular:

Estimate the total CO2 footprint for popular CryptoArt platforms:

[table=head]

Name | Gas | Transactions | kgCO2

OpenSea | 146,210,589,984 | 663,946 | 46,882,237

Nifty Gateway | 22,692,781,162 | 82,920 | 8,638,915

Rarible | 21,336,740,026 | 169,149 | 7,032,924

Makersplace | 20,254,567,543 | 64,625 | 5,490,208

SuperRare | 14,816,160,348 | 160,293 | 4,449,347

Foundation | 3,650,433,860 | 23,003 | 1,782,331

Known Origin | 4,457,508,470 | 18,223 | 1,355,487

Zora | 1,399,949,616 | 5,231 | 626,492

Async | 1,439,494,155 | 14,523 | 363,991

[/table]

They are kind of like the pressed pennies of the crypto world. You use some ethereum cryptocoin and the hash of a digital file to make a "special" cryptocoin that you may be able to persuade other people is worth loads of money. People have managed this feat.

Pointless because there is no legal backing to their representation of ownership. I can make a NFT from any digital file, whether I have any rights to it or not. And they will not survive quantum computers.

I am not sure how they are so bad for the environment, as ethereum should be better than bitcoin, but the numbers quoted are spectacular:

Lemercier’s first blockchain “drop” was placed for auction on a website called Nifty Gateway, where they sold out in 10 seconds for thousands of dollars. The sale also consumed 8.7 megawatt-hours of energy.

From here:

Estimate the total CO2 footprint for popular CryptoArt platforms:

[table=head]

Name | Gas | Transactions | kgCO2

OpenSea | 146,210,589,984 | 663,946 | 46,882,237

Nifty Gateway | 22,692,781,162 | 82,920 | 8,638,915

Rarible | 21,336,740,026 | 169,149 | 7,032,924

Makersplace | 20,254,567,543 | 64,625 | 5,490,208

SuperRare | 14,816,160,348 | 160,293 | 4,449,347

Foundation | 3,650,433,860 | 23,003 | 1,782,331

Known Origin | 4,457,508,470 | 18,223 | 1,355,487

Zora | 1,399,949,616 | 5,231 | 626,492

Async | 1,439,494,155 | 14,523 | 363,991

[/table]

Hygro

soundcloud.com/hygro/

The worst of real world constraints and augmented reality non-existence.

WSJ= OVERHEARD

As much as it tries to be the company of the future, Tesla shares a present-day problem with the rest of us—it has to deal with the Internal Revenue Service.

Tax rules were a boon when it was almost the only electric-vehicle game in town. Its well-to do customers got a $7,500 federal rebate and many states added to that. Now it has sold so many cars that customers no longer qualify for the federal subsidy. That matters more now that it is competing in the increasingly crowded mass-market category.

Buyers will face an even bigger hit if they choose to pay with bitcoin since the IRS will treat this as a sale of the recently appreciated asset. Say a buyer from California pays for its entry-level Model 3 sedan with $33,690 in bitcoin purchased three months ago. At the marginal tax rate of the average Model 3 buyer according to automotive research firm Hedges & Co., she would owe $4,056 at the federal level and $1,572 to California for short-term capital gains. Starting this year, cryptocurrency ownership has to be reported on federal returns.

The upshot is that, compared with, say, a rebate-eligible Hyundai Ioniq EV with an almost identical sticker price paid for in legal tender, the Tesla Model 3 buyer using appreciated bitcoin would pay 53% more after taxes.

As much as it tries to be the company of the future, Tesla shares a present-day problem with the rest of us—it has to deal with the Internal Revenue Service.

Tax rules were a boon when it was almost the only electric-vehicle game in town. Its well-to do customers got a $7,500 federal rebate and many states added to that. Now it has sold so many cars that customers no longer qualify for the federal subsidy. That matters more now that it is competing in the increasingly crowded mass-market category.

Buyers will face an even bigger hit if they choose to pay with bitcoin since the IRS will treat this as a sale of the recently appreciated asset. Say a buyer from California pays for its entry-level Model 3 sedan with $33,690 in bitcoin purchased three months ago. At the marginal tax rate of the average Model 3 buyer according to automotive research firm Hedges & Co., she would owe $4,056 at the federal level and $1,572 to California for short-term capital gains. Starting this year, cryptocurrency ownership has to be reported on federal returns.

The upshot is that, compared with, say, a rebate-eligible Hyundai Ioniq EV with an almost identical sticker price paid for in legal tender, the Tesla Model 3 buyer using appreciated bitcoin would pay 53% more after taxes.

If you wanted a car to do a bank job or something, it would make a lot of sense to use bitcoin. I am guessing that is not a major target market for them though.WSJ= OVERHEARD

As much as it tries to be the company of the future, Tesla shares a present-day problem with the rest of us—it has to deal with the Internal Revenue Service.

Tax rules were a boon when it was almost the only electric-vehicle game in town. Its well-to do customers got a $7,500 federal rebate and many states added to that. Now it has sold so many cars that customers no longer qualify for the federal subsidy. That matters more now that it is competing in the increasingly crowded mass-market category.

Buyers will face an even bigger hit if they choose to pay with bitcoin since the IRS will treat this as a sale of the recently appreciated asset. Say a buyer from California pays for its entry-level Model 3 sedan with $33,690 in bitcoin purchased three months ago. At the marginal tax rate of the average Model 3 buyer according to automotive research firm Hedges & Co., she would owe $4,056 at the federal level and $1,572 to California for short-term capital gains. Starting this year, cryptocurrency ownership has to be reported on federal returns.

The upshot is that, compared with, say, a rebate-eligible Hyundai Ioniq EV with an almost identical sticker price paid for in legal tender, the Tesla Model 3 buyer using appreciated bitcoin would pay 53% more after taxes.

Berzerker

Deity

some guy named Keiser talking up bitcoin

my buddy bought some, a few hundred I think and he was telling me to invest too

I really dont know enough about it, but I definitely like the idea

This Keiser dude said its big in Nigeria

Buy one tomorrow for $57,500. It can't go anywhere but up!

Berzerker

Deity

what was it 2 months ago? thats when my buddy bought in.

what I dont get is if you make money how do you cash in without accepting evil greenbacks?

what I dont get is if you make money how do you cash in without accepting evil greenbacks?

January 3 it was $33,000

February 3 it was $37,000

March 3 it was $50,000

March 12 it was almost $62,000

April 3 it is $57,500

https://www.coinbase.com/price/bitcoin

February 3 it was $37,000

March 3 it was $50,000

March 12 it was almost $62,000

April 3 it is $57,500

https://www.coinbase.com/price/bitcoin

You can exchange them for all sorts of useful stuff, like tesla's, drugs and guns.what was it 2 months ago? thats when my buddy bought in.

what I dont get is if you make money how do you cash in without accepting evil greenbacks?

[EDIT] And of course stolen jewelry, that has to be pretty close to "cash in without accepting evil greenbacks".

Last edited:

Thorgalaeg

Deity

I got some bitcoin and ether few years ago. I dont think on them that much. If they ever reach a price high enough so i don't have to work anymore i will sell, otherwise i will hold.

amadeus

rad thibodeaux-xs

I’m like two months late to this, but the only utility I’d see in it is as a replacement for a local currency that is rapidly devaluing and it’s easier to do transactions digitally than via paper notes and coins.What good are they?

Further in that case, circumventing local regulations that make fair market transactions otherwise impossible. I don’t think any country right now has both that situation and the mobile connectivity to replace something like paper dollars or euros though.

Similar threads

- Replies

- 165

- Views

- 7K