Who might have benefited?Alright, let's move beyond truisms. Can you talk about for which segments of society you think the most recent crash and recovery have been helpful?

Well, you may be right, which is why I used the word 'experiment' and said I was open to the possibility of that failing.

I suppose it's futile to talk about the internet in isolation from the rest of society. Destroy the power of the large corporations that currently control most of the internet and it's possible that what emerges would be a democratic internet.

So, let's talk about your ideas. Your position is presumably that the currently-existing "system" is the best possible one for promoting the most health and happiness while reducing hardship?

This is just a bad strawman. I explicitly said this was an idea I was willing to explore. You are projecting a caricature of Marxism onto me.

- Home buyers

- People with secure jobs (BTW 90% of the workforce remained employed)

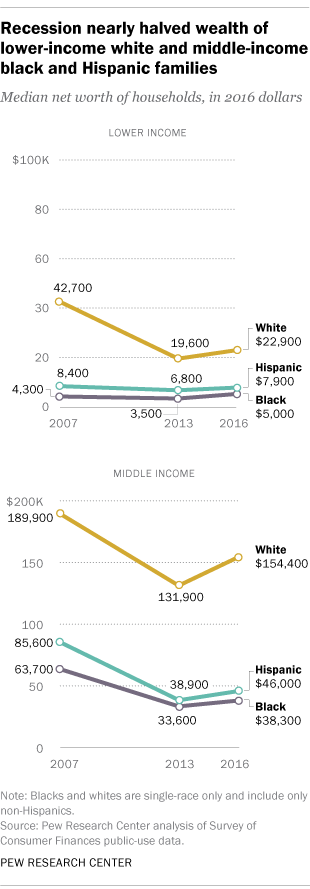

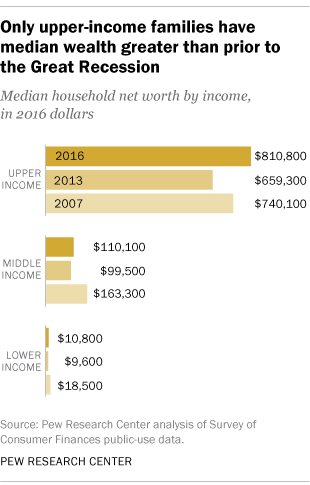

- Rich people

- Companies wanting to trim payroll costs

- Auto repair businesses

- Accountants

- Home remodeling businesses and stores

- Bargain and discount stores

- Beer, wine and liquor businesses

- Marginal workers

- Many debtors

- The 10% of the work force that lost jobs

- Those who lost houses, savings, etc.

- Many investors

- Those just entering the work force

- Weak small or large businesses go bankrupt

The fate of the big internet companies is still TBD and I think that breakups will happen. What those look like we'll have to see. It has happened before across different industries.

I certainly am not enamored with the current way capitalism works, but its benefits are huge. The two biggest problems I see are income/wealth inequity and money in politics. Things like the following should be up for discussion:

- Wealth Taxes

- Pay caps

- Increased regulations in many areas including banking

- Health care that eliminates the leading role of insurance companies

- A tax system that encourages giving ones wealth away for social good

- Real campaign donation limits

- Non partisan redistricting

- Forced matching of large political donations to social programs

- I think UBI is coming

You keep talking about central planning as the solution. I do tend to think of that as a mostly Marxist approach solving economic problems.

Absolutely.For rich people with cash recessions are “wonderful”, @Birdjaguar