You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

[RD] Daily Graphs and Charts

- Thread starter Winner

- Start date

- Status

- Not open for further replies.

Save_Ferris

Admiring Myself

"Greaser"? I've never heard that term used before.

SS-18 ICBM

Oscillator

Do you live in 1844?

Huayna Capac357

Deity

Well, some of those are still current (if a little obscure). For example, Bay Staters, Tar Heels, Wolverines.

SS-18 ICBM

Oscillator

The next available file was over 100 MB in size.

Why has Brent suddenly become so much more expensive than WTI?

Monsterzuma

the sly one

- Joined

- Jun 1, 2008

- Messages

- 2,984

may have something to do with how British North Sea oil is well beyond it's peak and has entered it's declining phase.

http://en.wikipedia.org/wiki/Brent_Crude

http://en.wikipedia.org/wiki/North_sea_oil

Although that doesn't explain the recent change.

Other reasons:

http://en.wikipedia.org/wiki/West_Texas_Intermediate

http://en.wikipedia.org/wiki/Brent_Crude

Brent Crude is sourced from the North Sea. The Brent Crude oil marker is also known as Brent Blend, London Brent and Brent petroleum.

Prior to September 2010, there existed a typical price difference per barrel of between +/-3 USD/bbl compared to WTI and OPEC Basket, however since the autumn of 2010 there has been a significant divergence in price compared to WTI, reaching over $11 a barrel by the end of February 2011 (WTI: 104 USD/bbl, LCO: 116 USD/bbl). Many reasons have been given for this widening divergence ranging from a speculative change away from WTI trading (although not supported by trading volumes), Dollar currency movements, regional demand variations, and even politics. The depletion of the North Sea oil fields is one explanation for the divergence in forward prices. In February 2011 the divergence reached $16 during a supply glut, record stockpiles, at Cushing, Oklahoma and is currently (August 2011) above $23. Historically the different price spreads are based on physical variations in supply and demand (short term).

http://en.wikipedia.org/wiki/North_sea_oil

Peaking in 1999, production of North Sea oil was nearly 950 000 m³ (6 million barrels) per day. Natural gas production was nearly 280×109 m³ (10 trillion cubic feet) in 2001 and continues to increase, although British gas production is in sharp decline.[19]

UK oil production has seen two peaks, in the mid 1980s and late 1990s, with a decline to around 300×103 m³ (1.9 million barrels) per day in the early 1990s.[20] Monthly oil production peaked at 13.5×106 m³ (84.9 million barrels) in January 1985[20] although the highest annual production was seen in 1999, with offshore oil production in that year of 407×106 m³ (2559 million barrels)[21] and had declined to 231×106 m³ (1452 million barrels) in 2007.[21] This was the largest decrease of any other oil exporting nation in the world, and has led to Britain becoming a net importer of crude for the first time in decades, as recognized by the energy policy of the United Kingdom.[22] The production is expected to fall to one-third of its peak by 2020.

Although that doesn't explain the recent change.

Other reasons:

http://en.wikipedia.org/wiki/West_Texas_Intermediate

Anomaly in 2011

In February 2011, WTI was trading around $85/barrel while Brent was at $103/barrel. The reason that most cite for this anomaly is that Cushing has reached capacity, depressing the oil market in North America which is centered on the WTI price. However, Brent is moving up in reaction to civil unrest in Egypt and across the Middle East. Since stockpiles at Cushing cannot be easily transported to the Gulf Coast for export, WTI crude is unable to be arbitraged in bringing the two back into parity.

Terxpahseyton

Nobody

- Joined

- Sep 9, 2006

- Messages

- 10,759

Prosecution of cannabis ownership in German states:

It shows what amount is defined as a "Small Amount". When caught with such an amount, legal prosecution must not be sought, while it still can be. If it's more, prosecution will commence out of principle. Orange means it won't commence out of principle, so a practical legal amount one may be caught with (while that amount will still be confiscated).

I am not sure about the other two, but I am told in the case of Berlin (lots of young hipsters) and Lower Saxony ("Niedersachsen", borders with Netherlands) that policy of practical legality is used because it would be too strenuous on the courts and the legal enforcement in general to prosecute them.

It shows what amount is defined as a "Small Amount". When caught with such an amount, legal prosecution must not be sought, while it still can be. If it's more, prosecution will commence out of principle. Orange means it won't commence out of principle, so a practical legal amount one may be caught with (while that amount will still be confiscated).

I am not sure about the other two, but I am told in the case of Berlin (lots of young hipsters) and Lower Saxony ("Niedersachsen", borders with Netherlands) that policy of practical legality is used because it would be too strenuous on the courts and the legal enforcement in general to prosecute them.

madviking

north american scum

Guess I'll be heading out to Schleswig-Holstein sometime soon.

Winner

Diverse in Unity

Prosecution of cannabis ownership in German states:

It shows what amount is defined as a "Small Amount".

Time to kick East Germany out of FRG

SS-18 ICBM

Oscillator

What's the minimum amount to get high anyway?

We will continue with this sunk cost fallacy forever! (Also, Saxony is actually quite decent if the people there keep their mouths shut.)Time to kick East Germany out of FRG

Terxpahseyton

Nobody

- Joined

- Sep 9, 2006

- Messages

- 10,759

1/4 gram if you have good stuff and 1/2 gram if you have mediocre stuff.What's the minimum amount to get high anyway?

Winner

Diverse in Unity

I don't even know what the number is in this country. Nobody cares, unless he's a dealer, so I guess the answer is "enough to get high together with 30 other people"

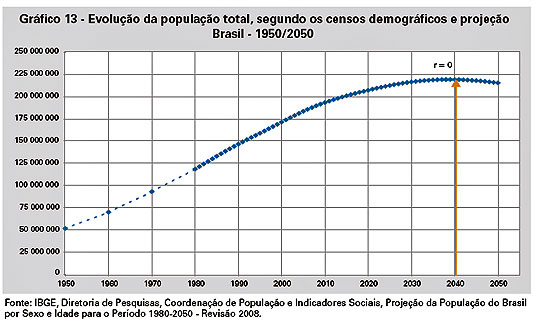

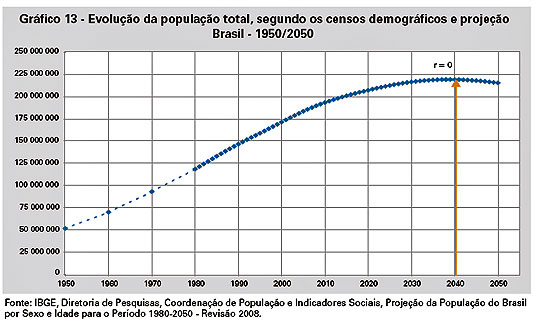

Population growth in Brazil, 1950 - 2050 (forecast, naturally)

What I find interesting about this graph (from 2010, IIRC) is how different it is from the ones I saw in school in the early 90's, which goes to show two things: how projections far into the future are unreliable and how malthusian fears of overpopulation are overhyped. Back in school I "learned" that the Brazilian population growth would slow down but remain at a high level, with the population peaking at around 400 million people and Brazil surpassing the population of the USA somewhere around 2030. All sorts of overpopulation nightmarish scenarios were imagined. Nobody predicted that population growth would essentially come to a complete halt. As we can see on the graph, the peak is now supposed to be at around 226 million people in 2040, a very modet increase from the present near 200 million. From then on it will decrease, so we will never match the USA. That's quite something for a country that from 1950 to 1970 doubled it's population and kept a high growth rate all the way to the 90's. Instead of worrying about overpopulation, we're now concerned with the effects of growing old while poor, with a vast and deficitary public pension system. Personally I foresee an economic collapse of biblical proportions.

What I find interesting about this graph (from 2010, IIRC) is how different it is from the ones I saw in school in the early 90's, which goes to show two things: how projections far into the future are unreliable and how malthusian fears of overpopulation are overhyped. Back in school I "learned" that the Brazilian population growth would slow down but remain at a high level, with the population peaking at around 400 million people and Brazil surpassing the population of the USA somewhere around 2030. All sorts of overpopulation nightmarish scenarios were imagined. Nobody predicted that population growth would essentially come to a complete halt. As we can see on the graph, the peak is now supposed to be at around 226 million people in 2040, a very modet increase from the present near 200 million. From then on it will decrease, so we will never match the USA. That's quite something for a country that from 1950 to 1970 doubled it's population and kept a high growth rate all the way to the 90's. Instead of worrying about overpopulation, we're now concerned with the effects of growing old while poor, with a vast and deficitary public pension system. Personally I foresee an economic collapse of biblical proportions.

Godwynn

March to the Sea

- Joined

- May 17, 2003

- Messages

- 20,524

we will never match the USA.

The earlier this is accepted, the easier it is to live with.

Haha, welcome to the developed world.Instead of worrying about overpopulation, we're now concerned with the effects of growing old while poor, with a vast and deficitary public pension system. Personally I foresee an economic collapse of biblical proportions.

Haha, welcome to the developed world.

I wish. You may have a deficitary pension system and bad demographics, but at least you're rich. Brazil (and probably China too) will experience what you guys in Europe experience without having the money. It's not a pretty picture.

It sounds bizarre to say it, but Brazil needs immigrants. And we might get them, it seems that since the earthquake 50 thousand haitians arrived. We should import bolivians too, and ideally unemployed europeans.

- Status

- Not open for further replies.